Record Start, Average Finish

But not a good record. The first two weeks of 2016 marked the worst start for the S&P 500.

Ever.

The entire month of January was the ninth worst since 1928. For some of you, a root canal may have been preferable. And it wasn’t just the S&P 500; it was all stocks across the globe, of all sizes. Fast forward to mid-year, and the United Kingdom votes to withdraw from the European Union – an event known as “Brexit”. More turmoil, though not as bad as January.

History tells us that the stock market as a whole has produced about a 10% average yearly return since its beginning. And at the end of a year where we saw the worst start ever, and a nasty summer surprise courtesy of Brexit, that’s what we got – about 10%. If you have exposure to bonds, as most of you do, you’d have a lower return, commensurate to your lower risk. It’s remarkable – since 1928, over a span of 88 years, the S&P 500 has come within two points of that average only five times. All others years were lower than 8% or higher than 12% (and as low as negative 44% to as high as positive 57%). It ended as a truly average year, despite starting as a truly horrendous one.

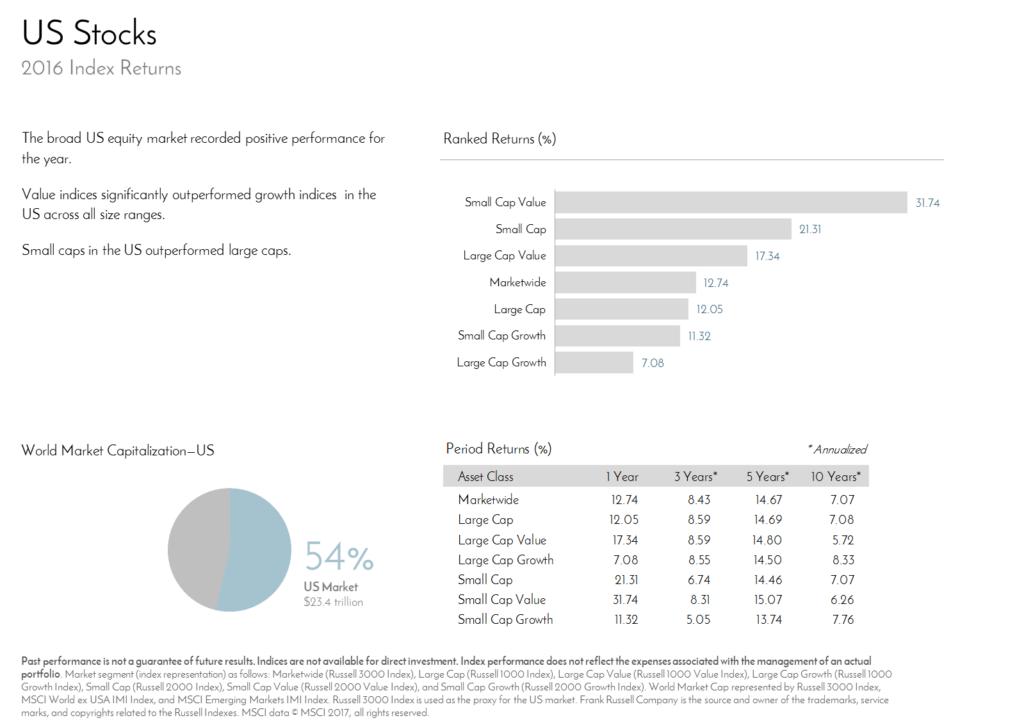

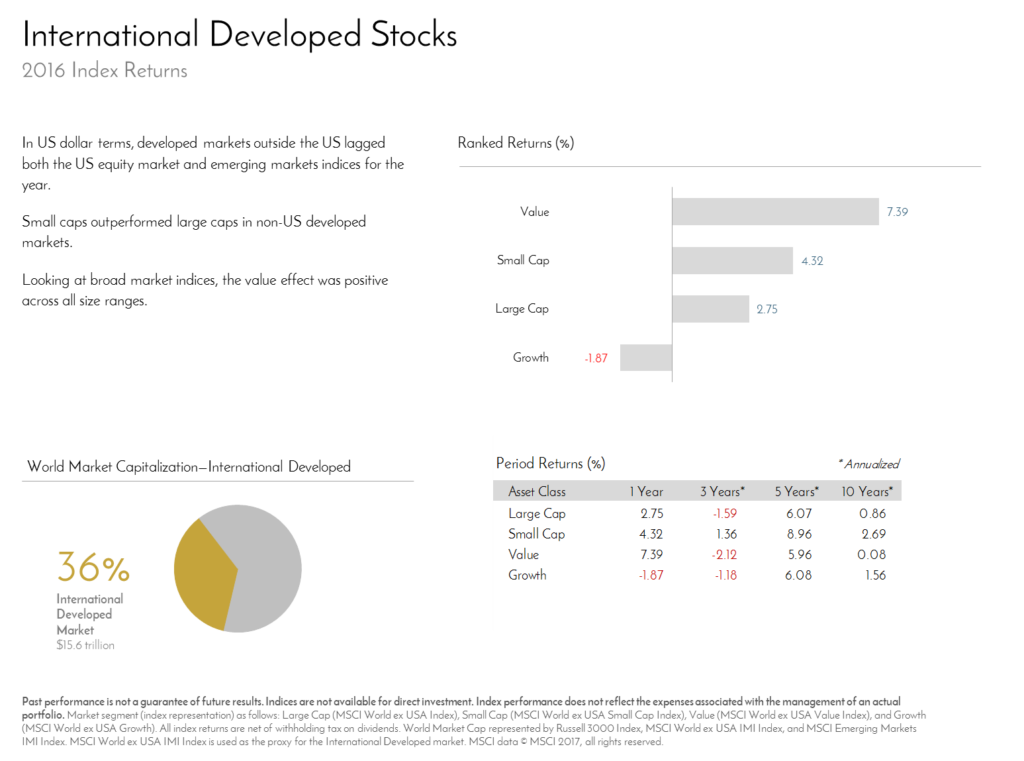

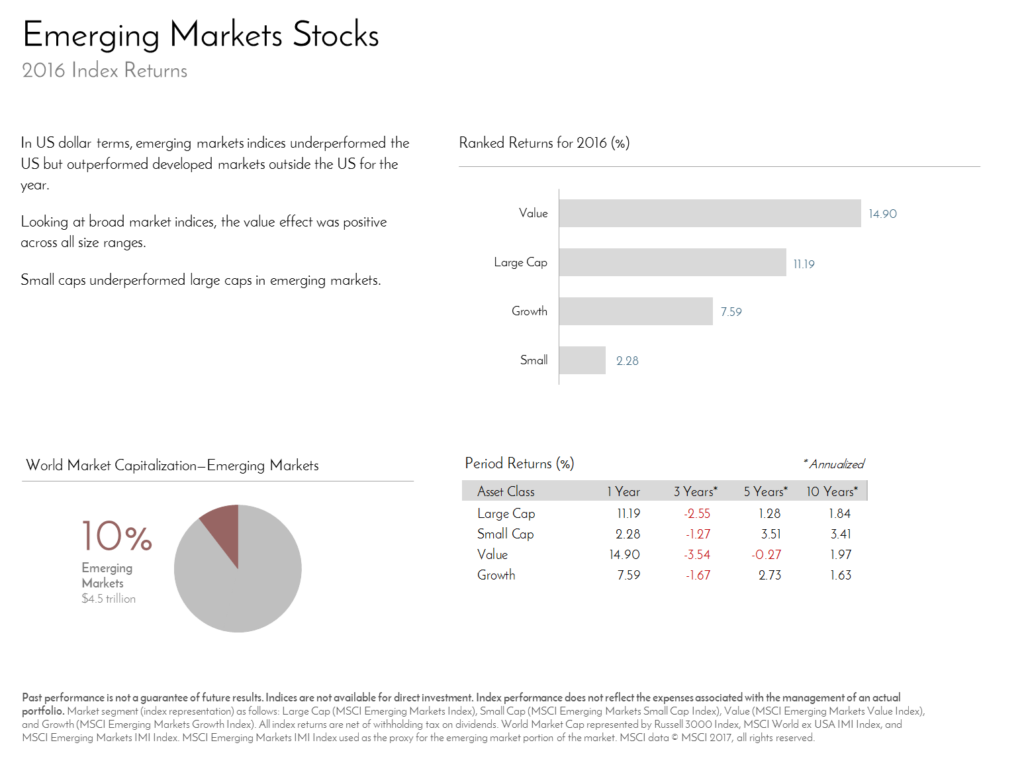

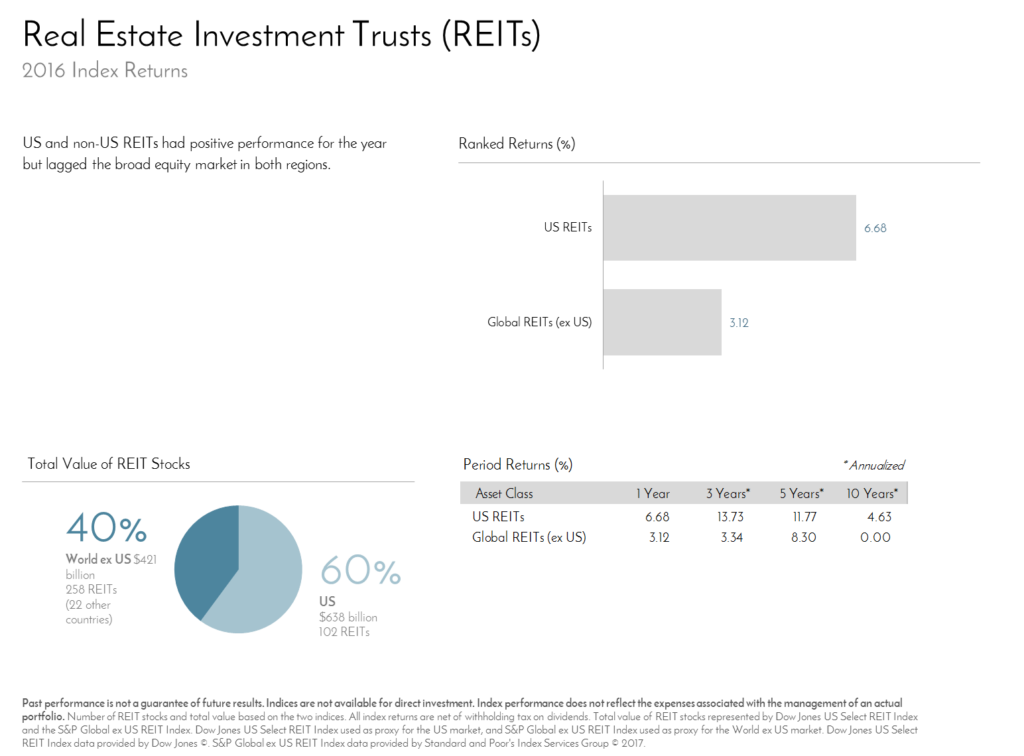

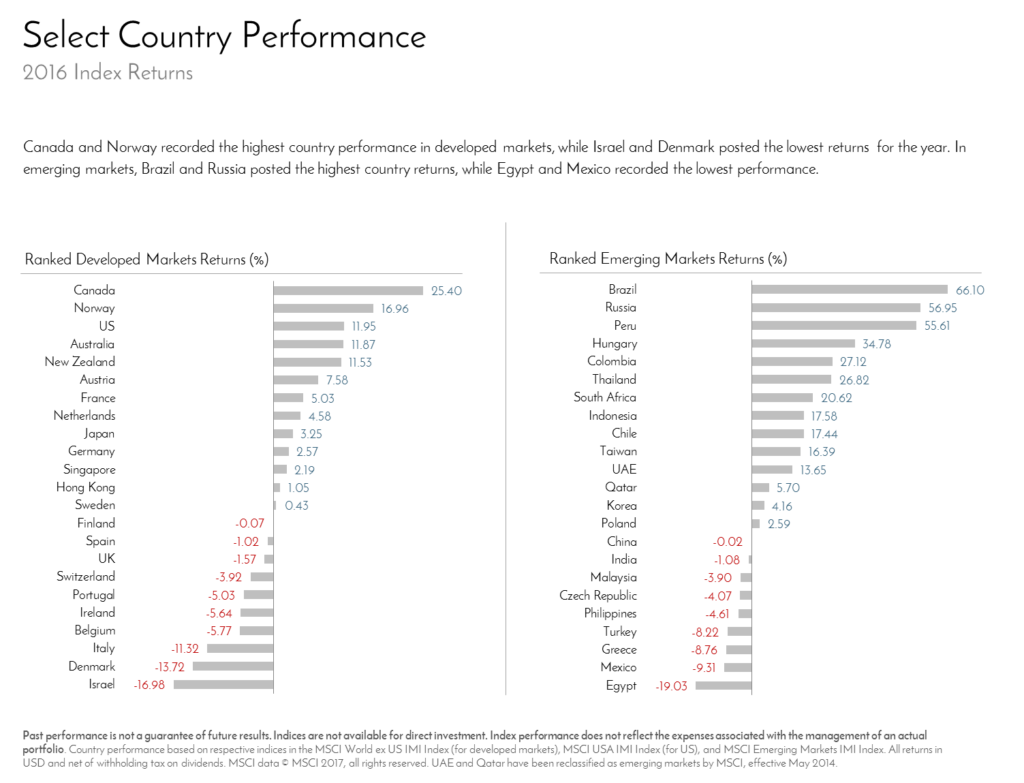

A wide range of outcomes added up to compose that very average number of 10%. In the US, small cap value stocks were up 32%, but large growth, only 7%, with everything else in between. Small cap and value also dominated international developed stocks, but not so for emerging markets. There, value won big, but small caps produced the lowest returns. Separating the best country from the worst country was an 85% difference in return, a quite normal spread between the two in any given year.

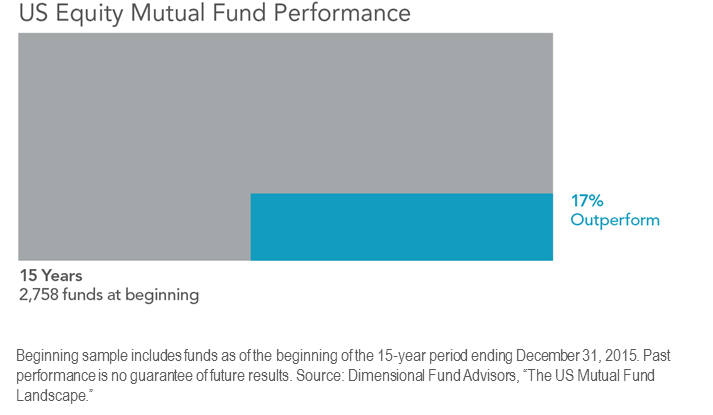

It’s tempting in times of such disparity to try to outguess the market and, say, avoid large growth at a 7% return in favor of small value at 32%. Or worse, bail out in January or during Brexit, and wait “until the market gets better”. But any individual trying to outguess the market is competing against the extraordinary collective wisdom of every investor in the world. The data urging us to sit tight and focus on the long term is robust. Here’s one example:

Mutual funds that try to outguess the market have failed miserably, as it is incredibly difficult and expensive to do. Over the long run, the result will almost assuredly be inferior when compared to the evidence-based approach that we embrace at Great Oak – an approach deeply rooted in the academia and science of investing, not in the marketing machine of Wall Street.

Once again, your perseverance is commendable, much like in 2015. Then, as in 2016, there were plenty of chances to let your emotions damage a sound investment strategy. But you didn’t. Here’s a little less scientific data to support our claim. Between January and Brexit, only one person called in a panic (see July’s post about John’s mom). A small handful of folks called just to ask a few questions. Everyone else went about their lives and let the market run its course. Despite the best efforts of CNBC, Jim Cramer, Money Magazine, Wall Street analysts and everyone else who profits from breeding greed and fear, you stayed strong and got what the market ultimately gave us – an average year.

Even John’s mom overcame her panic – and we assure you, she’s doing perfectly fine now.

Wishing everyone a prosperous year,

John & Bill