Data is the backbone of the “Evidence Based” investment approach, to which we fully subscribe. In its raw form, data is tedious and not much fun to read about. But the Wall Street Journal recently produced an article summarizing an important study in which the data ends the debate between our investment approach versus its antithesis, the “Wall Street” approach (i.e. based on making predictions and timing the market).

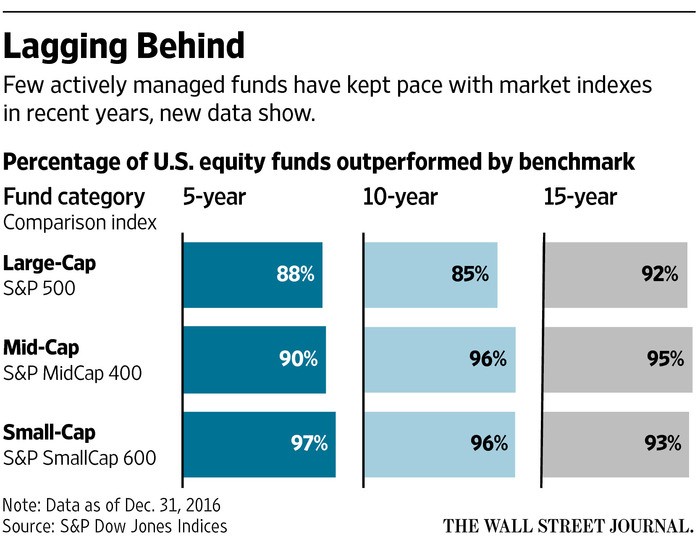

After all, data is evidence. Regarding our investment approach, if the evidence said otherwise, we would do otherwise. But the evidence says that costs matter, making predictions doesn’t work, and it’s about “time in” the market, not “timing” the market. Read the article below, particularly the graphic, to discover just how true this statement is.

Enjoy,

John & Bill

Indexes Beat Stock Pickers Even Over 15 Years

New data show that 82% of all U.S. funds trailed their respective benchmarks over 15 years

By Daisy Maxey and Chris Dieterich

April 12, 2017 7:31 p.m. ET

Most actively managed U.S. stock funds were beaten by their market benchmarks over the past decade and a half, a record of underperformance that helps explain why stock pickers are losing billions of dollars in assets each month to low-cost passive investments that track indexes.

Over the 15 years ended in December 2016, 82% of all U.S. funds trailed their respective benchmarks, according to the latest S&P Indices Versus Active funds scorecard. This was the first year that the analysis included 15 years of data, helping smooth out periods of volatility that can affect the performance of active managers.

The results coincide with the rise of passive investing and a growing view among investors and financial advisers that active managers can’t pick stocks well enough to justify the fees they charge over extended periods and that even those managers who do outperform their passive counterparts can’t sustain it year after year.

“We often hear from active managers, ‘You need to measure us over a longer-term cycle,’” said Aye Soe, managing director of research and design at S&P Dow Jones Indices. “Even over a full market cycle, which includes peaks and troughs, we still see the majority of active managers performing unfavorably against their benchmarks.”

The debate over whether passive management is as good or better than active management is a long-running and contentious one, but it has heated up in recent years. Active managers’ struggles to beat the market over recent years amid a long-term bull market in stocks have resulted in fee pressure, fund closings, business overhauls and mergers.

Investors have spoken with their wallets, turning to index-tracking funds in droves. Some $1.2 trillion has been withdrawn from actively managed U.S. stock funds since the start of 2007 through March, according to Morningstar Inc. Nearly the same amount, $1.1 trillion, has moved into passive U.S. stock funds over the same period.

Index giant Vanguard Group pulled in a net $33 billion in February, $29.6 billion of which went into index products, and $40.5 billion in March, $35.5 billion of which went into index products, a spokeswoman said.

Among more than a dozen categories tracked, 95.4% of U.S. mid-cap funds, 93.2% of U.S. small-cap funds and 92.2% of U.S. large-cap funds trailed their respective benchmarks, according to the data. The performance analysis, known as Spiva, is published semiannually by S&P Global using a methodology that includes funds that have been liquidated or merged out of existence. S&P Dow Jones Indices is a joint venture of S&P Global and CME Group Inc. It is a major participant in the indexing business with more than $2.1 trillion indexed to the S&P 500 index as of 2015.

A committee composed of three representatives of S&P Dow Jones Indices and two representatives of The Wall Street Journal determine the composition of the Dow Jones Industrial Average. Dow Jones & Co., a unit of News Corp , sold a majority stake in its index business in 2010 and sold the remaining stake in 2013.

S&P Dow Jones Indices pulls performance data on active funds from a database maintained by the Center for Research in Security Prices, a research and learning center at the University of Chicago Booth School of Business.

The latest Spiva survey period ended during a year of geopolitical tumult of the sort that sometimes is thought to benefit active managers, with market-churning events including Britain’s vote to exit from the European Union and Donald Trump‘s surprise election to the U.S. presidency. Not even the volatility that came with those events was enough to give many more active fund managers the edge over indexes.

S&P Dow Jones Indices found that 89.4% of U.S. mid-cap stock funds, 85.5% of small-cap funds and 66% of large-cap actively managed funds trailed their benchmarks in 2016. That came in a year in which stock markets performed well. The S&P 500 index delivered a total return of nearly 12% last year, while the S&P MidCap 400 and the S&P SmallCap 600 rose 20.7% and 26.6%, respectively.

Even stock funds that manage to top the market for many years can stumble badly. One high-profile example is Sequoia Fund, operated by Ruane, Cunniff & Goldfarb, a firm co-founded by William Ruane, a value investor and friend and mentor to famed investor Warren Buffett.

Until the end of 2015, Sequoia Fund was the top performing large-cap growth mutual fund tracked by Morningstar over the previous 15 years, nearly doubling the annual performance of the S&P 500. But the fund was badly burned by a heavy position in Valeant Pharmaceuticals International Inc. Valeant’s stock price has plunged 96% from its peak in August 2015 amid questions about its accounting practices.

Steep losses in Valeant have left the fund near the bottom of all large-cap growth funds over the past one, three and five years. The fund’s return over the past five years is less than half of the S&P 500’s 13.9%.

“We’re working very hard to restore the track record that our investors have come to expect from us,” said David Poppe, co-manager of the fund.

Original article: https://www.wsj.com/articles/indexes-beat-stock-pickers-even-over-15-years-1492039859