Many, if not most, people pick their investments based on recent returns. And that’s a huge mistake. Consider this data:

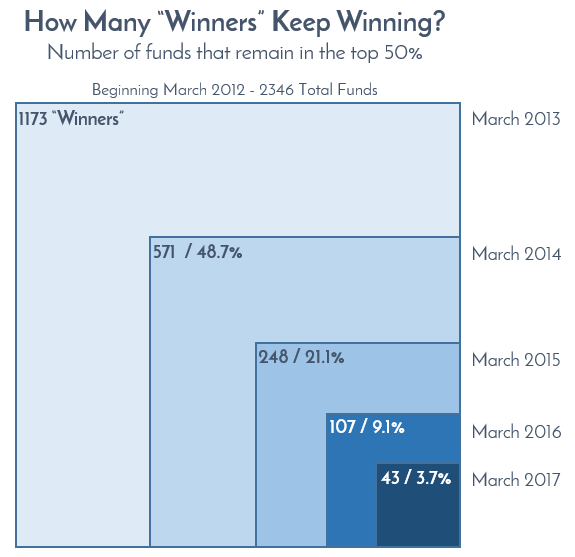

On March 31st, 2012, there were 2346 domestic mutual funds. One year later, 1173 funds (half) had placed in the bottom 50% of performance, leaving the other 1173 as “winners”.

If past performance is indeed indicative of future results, we would expect those 1173 “winners” to continue winning. They don’t – not by a long shot. By March of this year, only 43, or 3.7%, continued winning.

For those 43 funds, while a five year streak of staying in the top half of returns may seem impressive at first glance, know this: by pure random chance, 6.25% of the funds, or 73 of them, should’ve stayed in the top half. In other words, flipping coins would’ve been more successful in picking winners than looking at past performance.

To consider the managers of these funds skillful, we would need to see far more funds “win” than can be predicted by random chance. But we got the opposite. Even less funds were successful than should’ve been, based on random chance.

So what does work in picking funds? Two things. First, know the true cost (not just the expense ratio), and keep it low. Second, know the philosophy, and make sure it’s backed by science and academia. And if you’re not sure about either, just ask us. We’ll be glad to help.

Cheers,

John & Bill