“The ability to foresee that some things cannot be foreseen is a very necessary quality.”

The French philosopher Jean Jacques Rousseau probably didn’t know how relevant to investing his words were. But over 250 years after he wrote them, a client reminded us of Mr. Rousseau’s genius when that client sent us this, back in August:

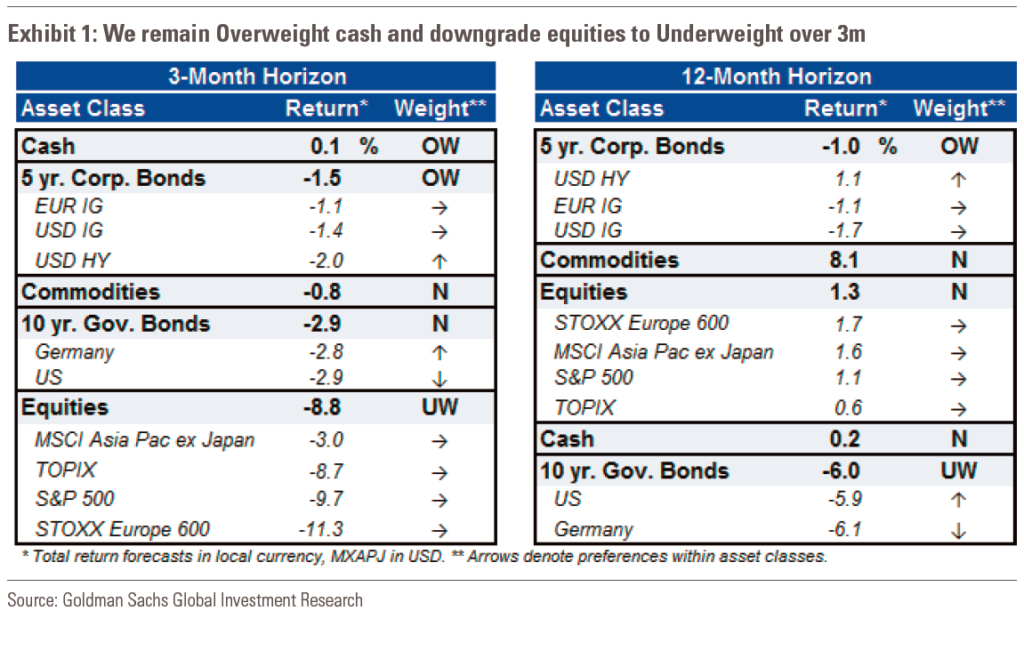

This is a Goldman Sachs forecast, issued in early August. Our client was very nervous that Goldman Sachs believed the stock market would be down 8.8% over the next three months.

Fast forward…

The sun is shining, our client is happy, and, despite the tremendous effort and resources that went into that prediction from Goldman Sachs, we made no changes for any client. The result? The market has been flat, not down 8.8% as predicted.

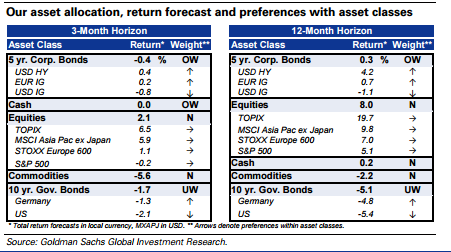

The article that client showed us referenced a previous prediction in May. We thought it would be worth a read. Here it is:

Not as dire in May, as they predicted a 2.1% run up in stocks over three months. But just as wrong, as stocks increased 7.3%. They weren’t alone in this one, as Merrill Lynch and J.P.Morgan hopped on the bandwagon.

We’ve read predictions that turned out to be true. But one prediction never fails to disappoint: that no one can predict whose predictions will be right. And that makes predictions worthless.

For the record, we’re not picking on Goldman Sachs in particular. We’re sure they’ve been right before.

As is a broken clock, twice a day.

And that’s why we embrace the Evidence-Based Approach to investing. No crystal balls, no dice rolling, no disappointing predictions, and certainly no regard for short-term noise. Instead, we rely on peer-reviewed academic research, empirical data, and objectivity – all with a long-term view. Hopefully Goldman gives out earplugs to their clients. The short-term noise over there must be deafening.

Cheers,

John & Bill