Like a Good Basketball Game, It Came Down to the Fourth Quarter

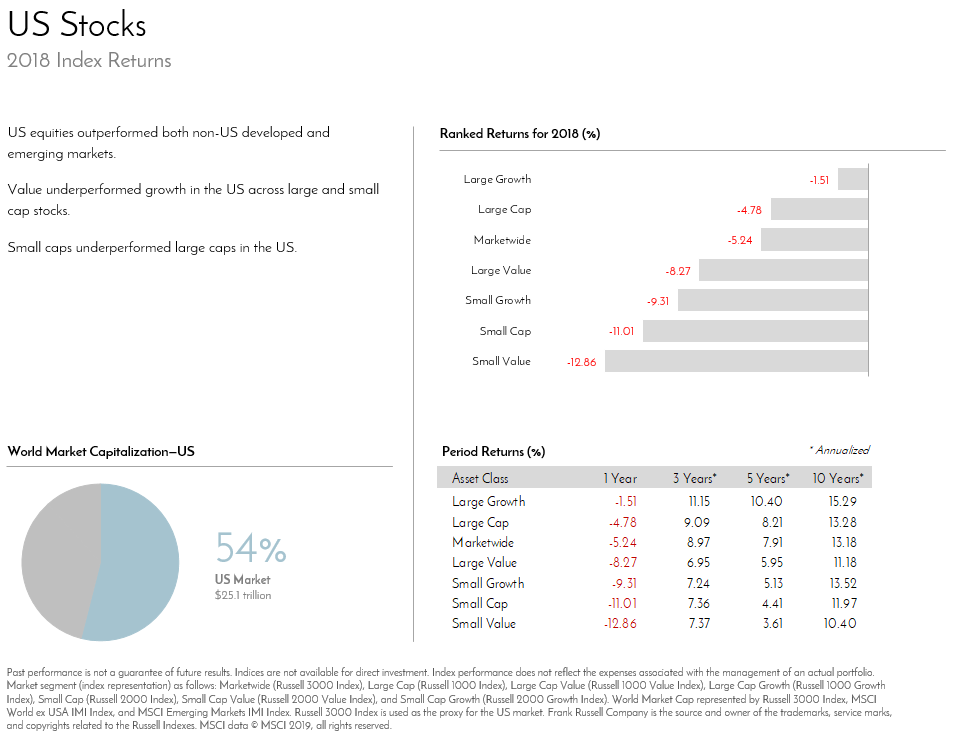

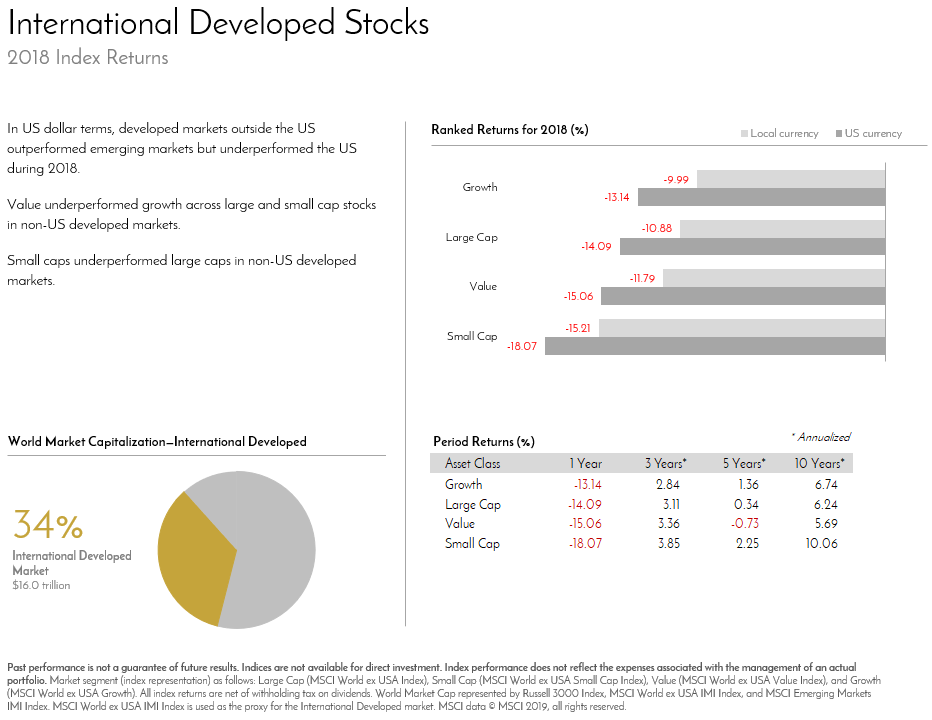

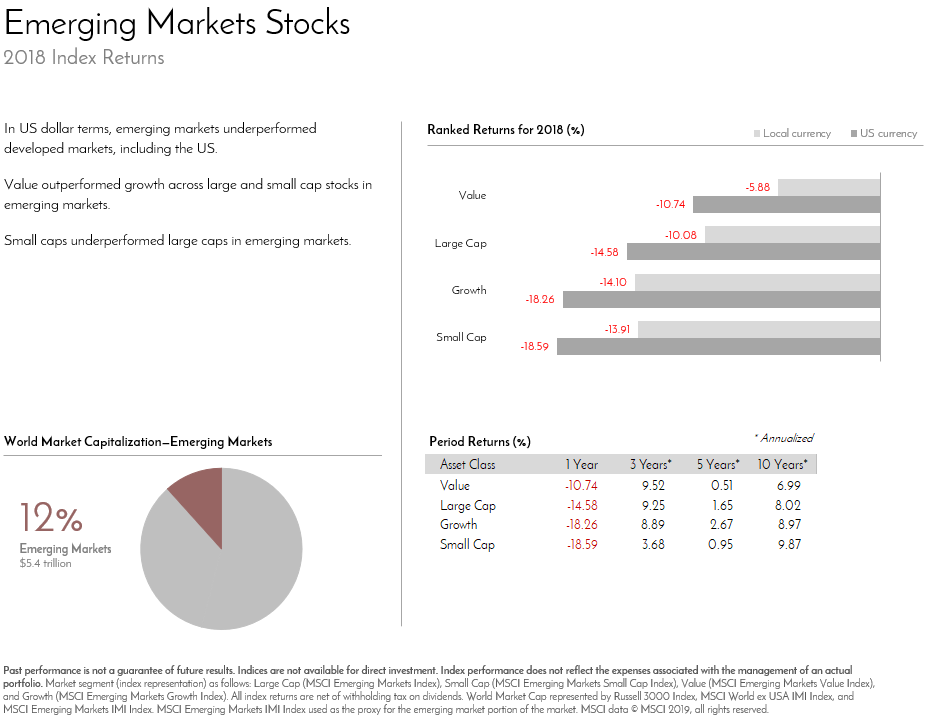

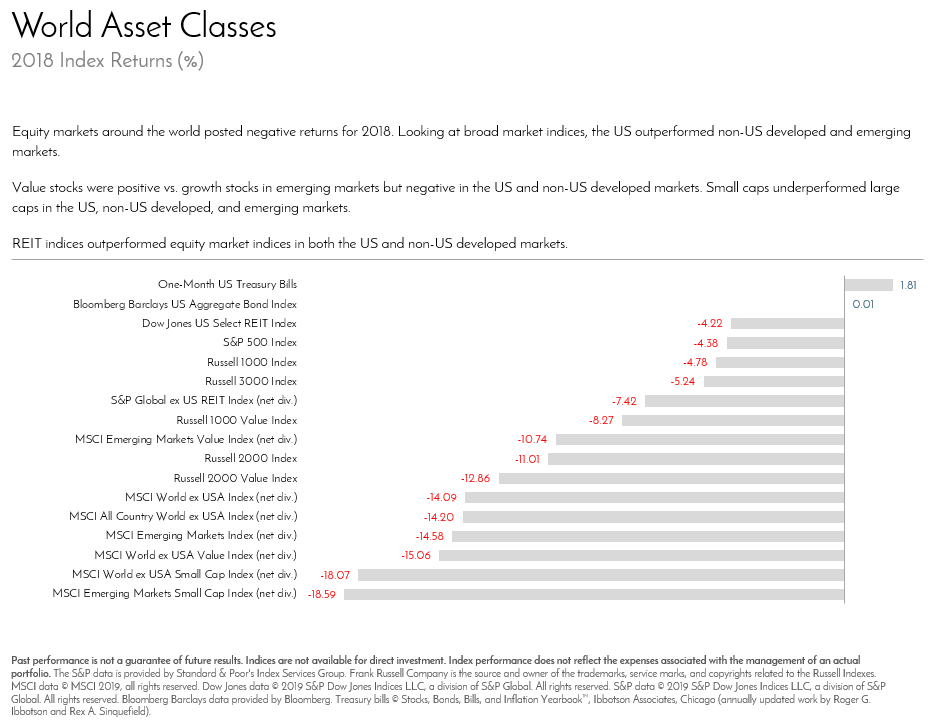

We started the year with a pop and a pull back. When the dust settled in February, nothing else spectacular happened, as the market ground out a slow and steady 5% return through mid-September. Then, as the fourth quarter unfolded, only the good people of Qatar in the Middle East stood as victors in the end, with their country’s stock market posting the only gains on the planet for 2018, and by a landslide – up 27%.

While most of the damage came within the fourth quarter, the slide began on September 24th. After a breather throughout November, the slide continued until Christmas Eve, culminating in our first bear market since 2009. Qatar aside, no one was spared – no country, no class of stock, be it large cap, small cap, value, growth, and anything in between. All saw negative results in the stock market for 2018, as the fourth quarter brought a 14.6% drop, on the way to a 21% drop by Christmas Eve from the highs of last January.

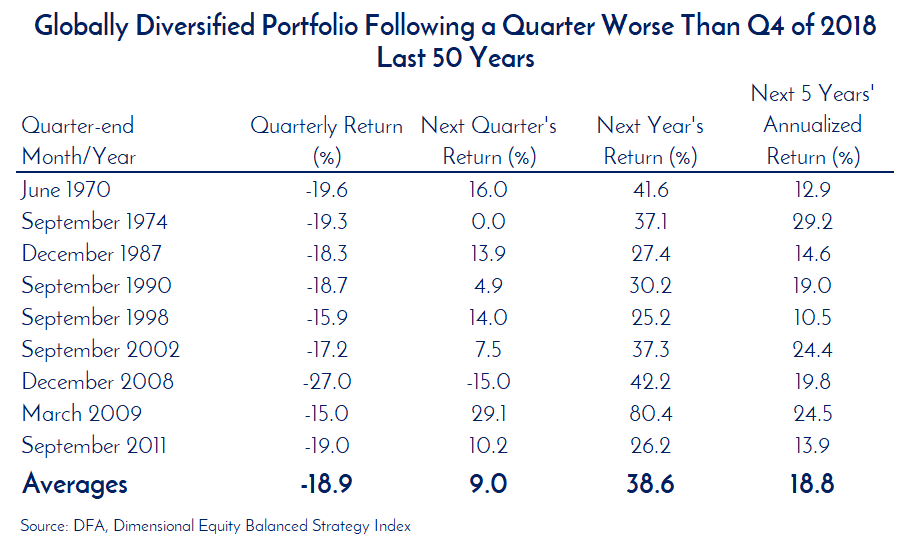

A bear market is a drop of 20% from the recent high, which in this case was in January 2018. Bear markets are more common than recent history would suggest: we’ve had 25 over the last 90 years, or about one every three and a half years. Quarters worse than the last are almost as common. We spent weeks (OK, an hour) cobbling together a list of such quarters in the last 50 years, to answer the question that everyone is asking: “What happens now?”

Of course, there is no way to answer that question. An answer would be a prediction, and predictions are worthless (link to blog). But historical context is useful, particularly in times of stress. While we don’t know what will happen, here’s what has happened…

We constantly preach patience and discipline, particularly in stressful times. A look at this chart tells you why. Sadly, too many people don’t stay the course, believing that “it’s different this time”. You’ll find no more dangerous words than those. No one who’s uttered them has ever been correct. Ever. The proof is right there in the numbers. We suppose if anything has been different, it’s been the size of the recovery. Either it’s been really good – 25.2% in a year – or off the charts – 80.4% in a year.

The question everyone should be asking is “What do I do now?” And the only answer they should hear is “Nothing.” Inaction, not action, is always the best answer to market volatility. Only life events, like retirement or marriage, should be cause for changes to a portfolio, assuming your portfolio is properly built in the first place. And if you’re with us, we have that covered.

Wishing everyone a prosperous year,

John & Bill