Oops, They Did It Again!

We imagine it went something like this, just before 2021 rang in:

Analyst: Well that was a crazy year! 22 percent? Didn’t see that coming, with all this covid.

Other Analyst: The S&P? It was up 18.

Analyst: I meant my bonus. But yeah, 18 percent – wow. I’ll take it. I guessed only 8. Still better than your guess! 5, wasn’t it?

Other analyst: Whatever. I got the same bonus. But seriously, the boss wants a prediction for next year. I mean, we really can’t go up more with all these variants popping up, right? They’ll have to switch to Sumerian when they run out of Greek letters. Whatcha think?

Analyst: I hear that. There’s no way it-

Other Analyst: Not you. You!

IT Manager: Wha- me? I’m just here to fix the keyboard you spilled that expensive bourbon on at the holiday party. But since you’re asking, maybe 3 percent at best? I mean, things aren’t much better yet.

Other Analyst: Then 3 percent it is! Alright, it’s Miller time.

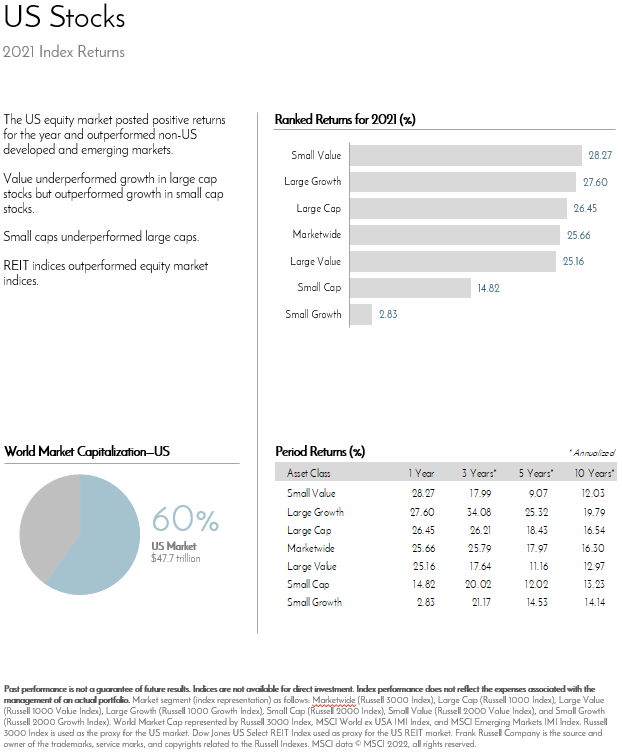

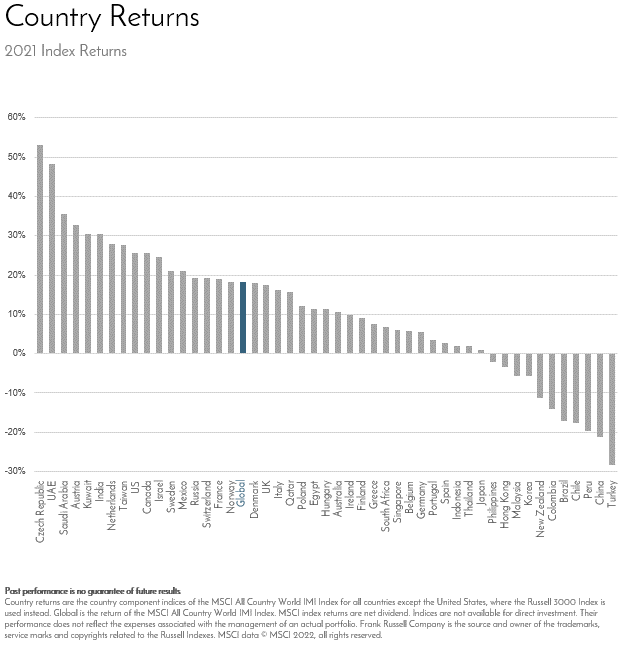

We’d like to think the approach to forecasting is a bit more scientific than that. We’re sure it is. There must be a spreadsheet involved, at least! But the results do not speak for themselves. Three percent. That was the median projected total return for the S&P 500 for 2021, according to a Bloomberg survey of market analysts. The S&P 500 averages 10 percent. We got 28.7 percent. And all-time highs…again.

Sure, the folly of prognostication is ubiquitous. But that’s not the real lesson here. More important perhaps is the reason their guesses were not just off, but so low.

Can you really blame the analysts? (Yes, but, just play along.) Life is not back to normal and was less so 13 months ago. To most at the time, the markets felt extra risky, especially coming off a gain of 18 percent in 2020 despite a pandemic (and a 68 percent rally from the bottom that March). It was time for a drop…right?

Maybe. Maybe not. No one knew. No one will ever know.

The reason we expect and have enjoyed an average yearly return of about ten percent over the history of the market is the inextricably related risk. Covid, wars, bubbles, Y2K, assassinations, inflation, deflation, Brexit, politics, the return of the McRib. There’s no shortage of reasons on any given day to think the market will go down.

And it will.

Ironically, that’s why it goes up eventually. We as investors demand a higher return than the bank offers to compensate us for taking risk, for temporarily, but seemingly endlessly, having to watch our 401k’s get rattled. Simply, risk equals reward.

The inconsistency of that reward is why investing is a long-term endeavor requiring patience and discipline. Sure, we got the reward last year. But has it been easy? The urge to “get out” is real. We’ve already been reminded of the risk we must endure through this first month of 2022. Not fun. But you made it through the “covid drop”, and so many others before that. You know what to do. Stay disciplined, be patient, and expect success.

Wishing everyone a prosperous year,

John, Bill, Mark & Melanie