2022 brought us two things: a bad market and some rule changes. First, the market.

We’ll let you fill in your own description: “That was a really ________ market.” We wonder how many of you wouldn’t share with an eight-year-old what just came to mind. We don’t blame you!

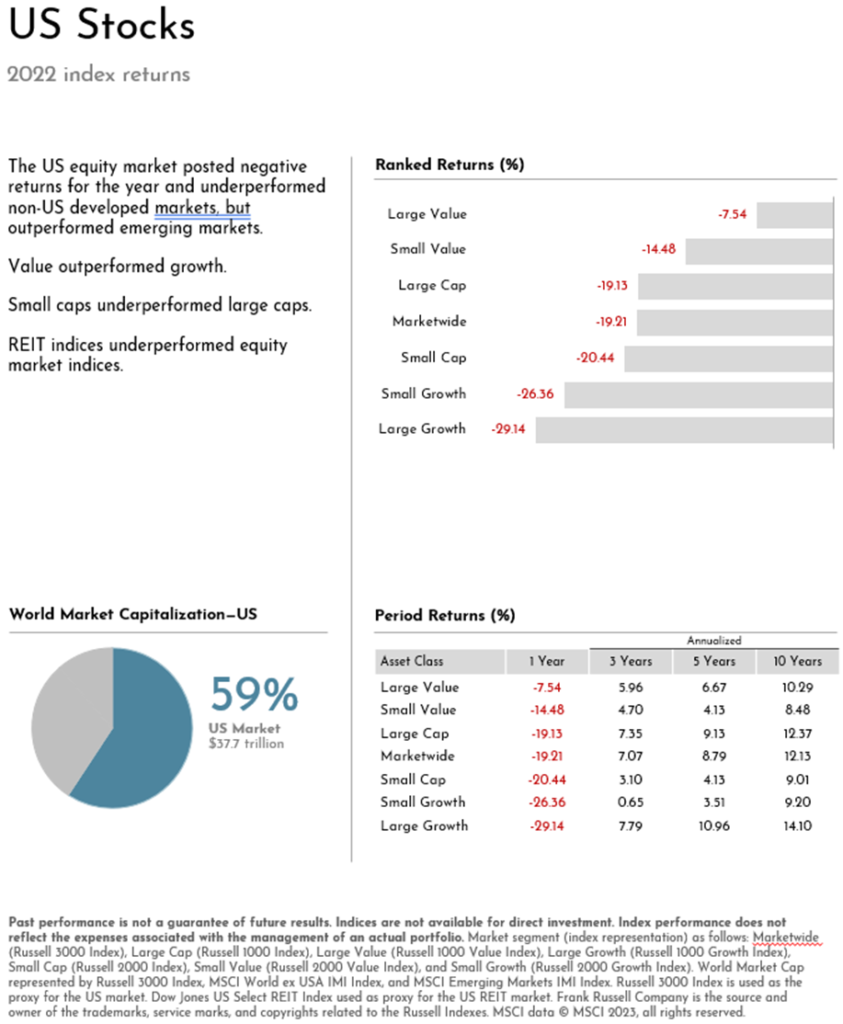

We peaked at the beginning of the year and never looked back as we slid slowly, painfully for nine months into bear market territory, with US stocks shedding 19.6% by December 31st. Remember the “Covid drop”? 35% in 33 days. Yet, last year felt worse as the slide just dragged on and on. After the Covid drop, we rocketed back to new highs. The general lack of patience that infects the investment world is what made last year feel worse.

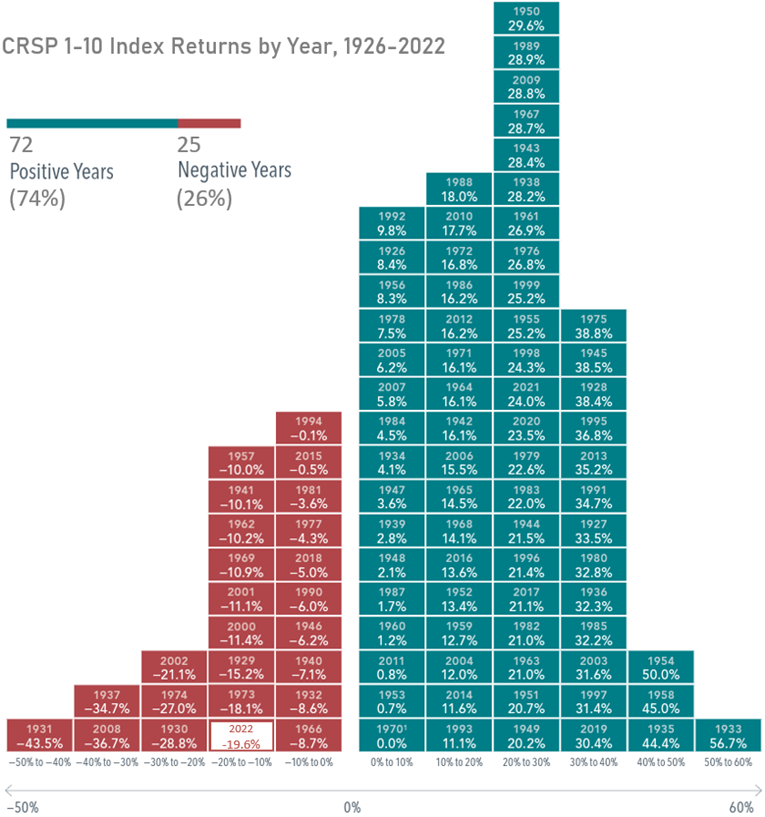

Let’s get some perspective on where the year fell relative to others, and how often we get bad years. Take a look:

The CRSP 1-10 Index represents the entire US market. Only six years since 1926 have been worse. We were headed towards those other six until September, when the silver lining peeked out and the bottom was hit. The 18% rebound through yesterday has been soothing, but it’s still a work in progress. As a client, last year didn’t hurt as much, with diversification softening the blow, culminating in a drop of 11.6% for stocks. Still rough, but we’ll take it!

The lesson here is what you’ve surely noticed: up years far outnumber the down years. Seeing that, the positive return of the market over time makes sense. For your own portfolio to be positive, it takes patience. As Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” The path to success is clear.

Now for some rule changes, courtesy of the Secure Act 2.0, passed just before Christmas. There are 90, so we’ve boiled it down to those you might find most pertinent:

- The age at which you must take a Required Minimum Distribution from your retirement account will increase to 73 (previously 72, more previously 70 ½). Starts now

- The RMD age will increase to 75 in 2033

- The penalty for not taking your RMD will decrease to 25%, from 50% previously. Starts now

- Roth accounts in employer retirement plans will be exempt from RMDs. Starts in 2024

- Roth contributions to SIMPLE and SEP IRAs will be allowed. Starts now

- Workers aged 60 through 63 will be able to make catch-up contributions up to $10,000 annually to their employer retirement plans, indexed to inflation. Starts in 2025

- For those earning over $145,000 per year, all catch-up contributions will need to be made to a Roth account in after-tax dollars. Starts in 2025

- Matching employer contributions may now be made to Roth accounts (previously pre-tax only). Starts now

- Employers will be able to “match” employee student loan payments with matching payments to a retirement account. Starts in 2024

- After 15 years, 529 plan assets can be rolled over to a Roth IRA for the beneficiary, subject to annual Roth contribution limits and an aggregate lifetime limit of $35,000. Starts in 2024

- A national searchable lost and found online database for forgotten retirement accounts will be created. Starts in 2025

- It is easier to put annuities into retirement plans. Starts now…BEWARE!!! THIS IS NOT GOOD

Well, I guess we ended on a down note! Please, reach out with any questions. We are happy to explain any of this to you, and how it might affect your situation.

Lastly, thanks for hanging in there. It was a tough year. We appreciate your trust and confidence more than you know.

Cheers,

John, Bill, Mark & Melanie