You Asked, So We’ll Answer

FOQ: Aren’t dividends from stocks a good way to generate income?

Short: Nope.

Long: Focusing on dividend paying stocks for income presents a bunch of issues: lack of diversification, tax inefficiency, timing of payments and size of payments.

FOQ: I’m guessing that’s bad, right?

Short: Yup.

Long: Diversification is a pillar of prudent investing. Yet only roughly half of global stocks pay a dividend. So loading up on them would cut your diversification in half, at least. And in our experience, those seeking dividend income tend to concentrate their holdings to 50 or so stocks, a far cry from the 14000-ish you should own.

Dividends are taxable. So if you receive dividends that are more than you need, you’ll pay more in taxes than you should.

Dividends are paid on a schedule and at a rate set by the company that pays them. And it’s unlikely that their payment schedule and rate align with your income needs.

FOQ: So what do I do?

Short: Focus on “total return”.

Long: Build a diversified portfolio underpinned by a sound plan and sell what you need when you need it. This way, you take on less risk, and you control how much income you receive and when you receive it. Don’t worry about where your income comes from, as long as you strive for the highest return for the lowest risk, i.e., total return.

FOQ: But aren’t dividends “free” money? Like bank interest?

Short: We wish.

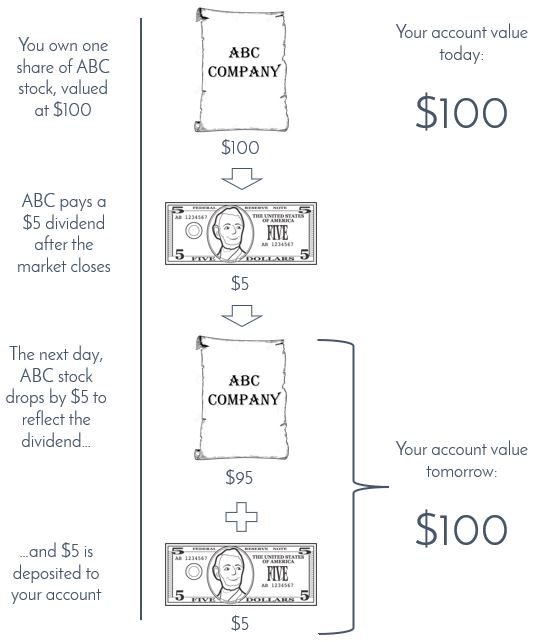

Long: Many believe that dividends add to your return – that, for example, a 5% dividend yield is equal to 5% interest from a bank (in 1982!), where you’d have more money after the interest was paid. That’s not true. Here’s an illustration on how it works:

No free money here! The stock price drops by the amount of the dividend. Here’s why. Imagine your wallet, for which you just paid $20, has $200 inside. So it’s worth $220 in total. Then you take out $50 as a “dividend”, leaving your $20 wallet with only $150 inside. What’s it worth now? After this “dividend”, would anyone buy your wallet for $220 now? Of course not. Now it’s worth only $170. Add back the $50 “dividend” you put in your pocket, and you’d still have $220 – no more, no less.

Let us be clear. Dividends are in no way harmful. Only the myths surrounding them are.

Cheers,

John, Bill, Mark & Melanie