You Asked, So We’ll Answer

FOQ: Why are people talking about a government shutdown?

Short: There might be one.

Long: Since a 1980 interpretation of the 1884 Antideficiency Act, the government must shut down if Congress fails to pass a budget and can’t pay its bills. During a shutdown, only departments covering the safety of human life or protection of property will continue to operate (military, federal hospitals, etc.). While a deal was recently reached to hopefully get us through September, it may not be enough. Congress really has until June to get something more substantial in place.

FOQ: Does it matter to the markets?

Short: Nope.

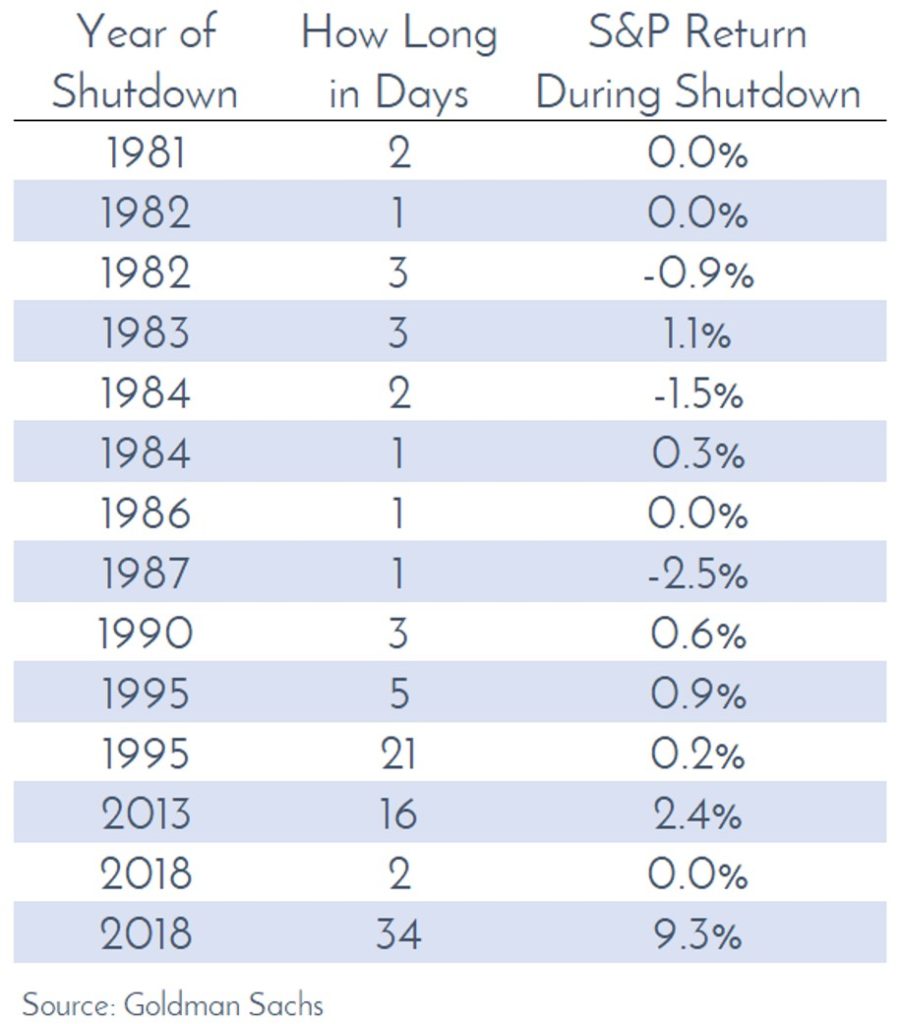

Long: Here are all the shutdowns since 1980, and how the S&P 500 did during them:

Only the last one stands out – in a good way. As for the others, it all averages out to a big fat zero. Nothing to see here, as they say. Regardless, you can bet CNBC will have a “Markets in Turmoil” segment about it!

FOQ: So I shouldn’t do anything?

Short: Correct.

Long: Add this to list of everything that the market ever worried about – wars, presidential assassinations, Brexit, Covid, Y2K, 9/11, Black Monday, the Tech Crash(es)…the list goes on – then remember that none of these things had any lasting impact on the markets.

We guess “shouldn’t do anything” is inaccurate. Please, do stay patient, do stick to your plan, do ignore the hype. And then, and only then, expect success.

Cheers,

John, Bill, Mark & Melanie