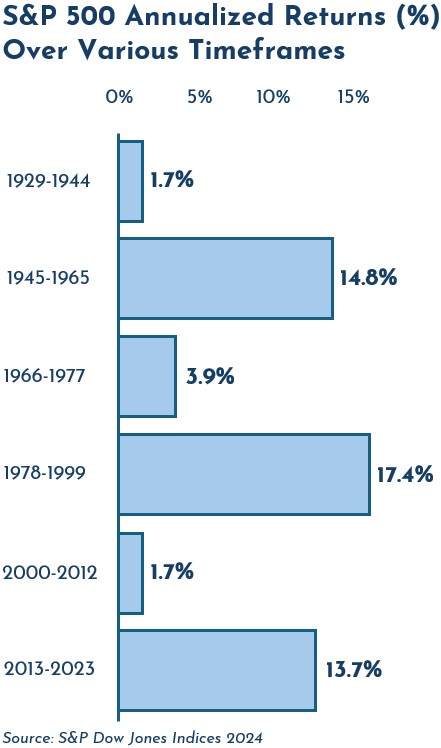

Folks, the S&P 500:

It’s tough to imagine those bad periods, right? We’ve been in a good one for quite some time now. Of course, within all the good periods were some duds (like 2022), and within the bad, some good (like 2003). But it’s been quite a run, especially when you consider that what the S&P 500 represents – large US companies – has given us the best returns since 2013 – better than value, small cap, foreign and emerging market stocks.

Therein lies the danger! While 11 years seems like a long time, a statistician will tell you it’s meaningless in this case. Also, we tend to overweight short term data at the expense of long term data. By doing so, we may find ourselves foregoing all those other asset classes. And that’s costly. Throughout the history of the market, diversifying into foreign and emerging market stocks has lowered our volatility (less ups and downs). More importantly, adding value and small cap stocks has increased our returns significantly (here, about 2/3’s the way down: https://greatoakcp.com/costs/).

Stuffing too much money into an S&P 500 index fund or a Target Date fund* (which tends to overweight the S&P 500) is a mistake. Stay diversified and you will be in the best position to reap the most reward from your investing experience.

Afterall, could you stay invested after getting only 1.7% annualized over 13 years?

Cheers,

Your Team at Great Oak

*Target Date funds are those you will find mostly in a workplace retirement account, with names like “2035 Fund”, etc.