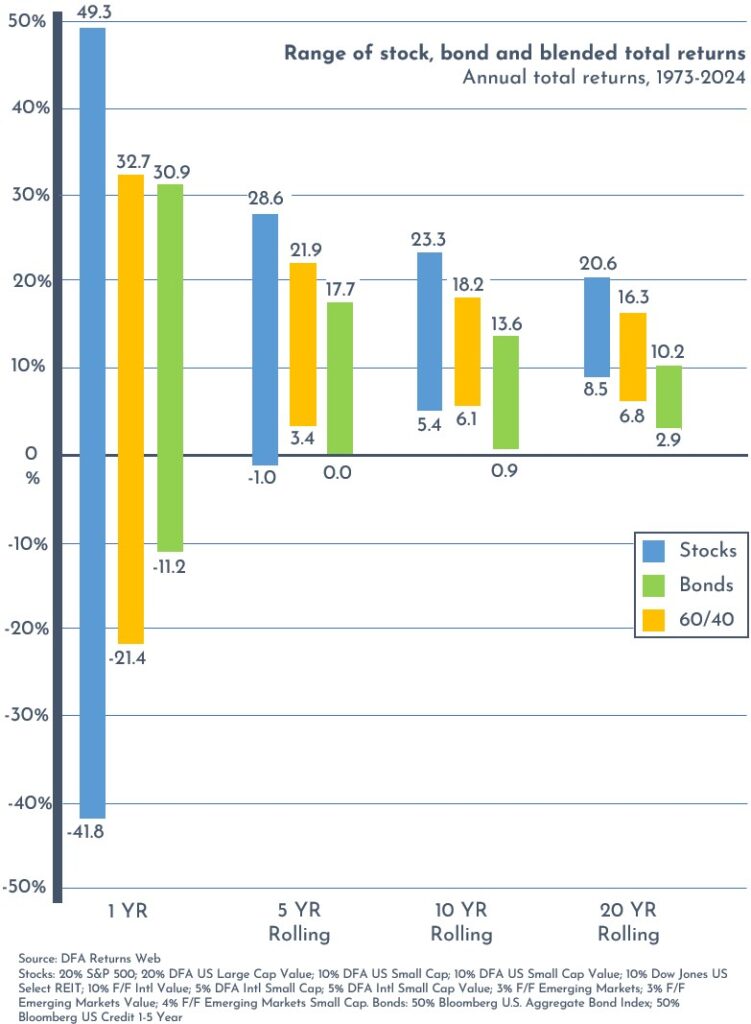

Behold the effect of time on markets:

Allow us to explain. You’re looking at the best and worst returns of stocks (blue), bonds (green) and a mix of 60% stocks to 40% bonds (orange), over four different time frames. One-year returns are straightforward. For the 5-year returns, “rolling” means from 1973 to 1977, from 1974 to 1978, from 1975 to 1979, and so on. Same for ten and twenty years. The returns are annualized. For example, the best 10-year return for bonds was 13.6% per year. The worst was 0.9% per year.

Let’s focus on the stock returns in blue, as that’s what everyone is usually worried about. In any year, anything can and has happened. Making 49.3% in a year is great, but losing 41.8% is not. That’s why investing is for the long term. Look how much the range of outcomes shrinks when we go out to 5-year returns. There, the worst case has been a negative 1% per year loss. Not terrible, but it’s why with 5-year time horizons, you’ll typically have bonds in the portfolio, bumping the worst case up to a positive 3.4%.

At 10-year returns, we now see why the manifestation of risk in the last three weeks is not worth your time and energy. Sure, it hurts to see the market down 5% in a few weeks. Fortunately, throughout all the terrible market drops we’ve all faced, the worst 10-year period for stocks still produced a positive 5.4% per year return, even though that time began with the Tech Bubble bursting and ended with the Financial Crisis. Two events that walloped the market, yet investors – those in it for the long-term – came out on top.

Be an investor. If we’ve recommended that you have money in stocks, then you have the time to let it play out and recover. Think long-term. We know – easier said than done. And that’s why we’re here for you. Want to talk more about it? Call us. Or better yet, come in to see us. Or we’ll come see you. Let us remind you why you’re invested the way you are, and how seven decades of science, academia and mathematics underpin your strategy. Your investments will be just fine. Let’s make sure you are too.

Cheers,

Your Great Oak Team