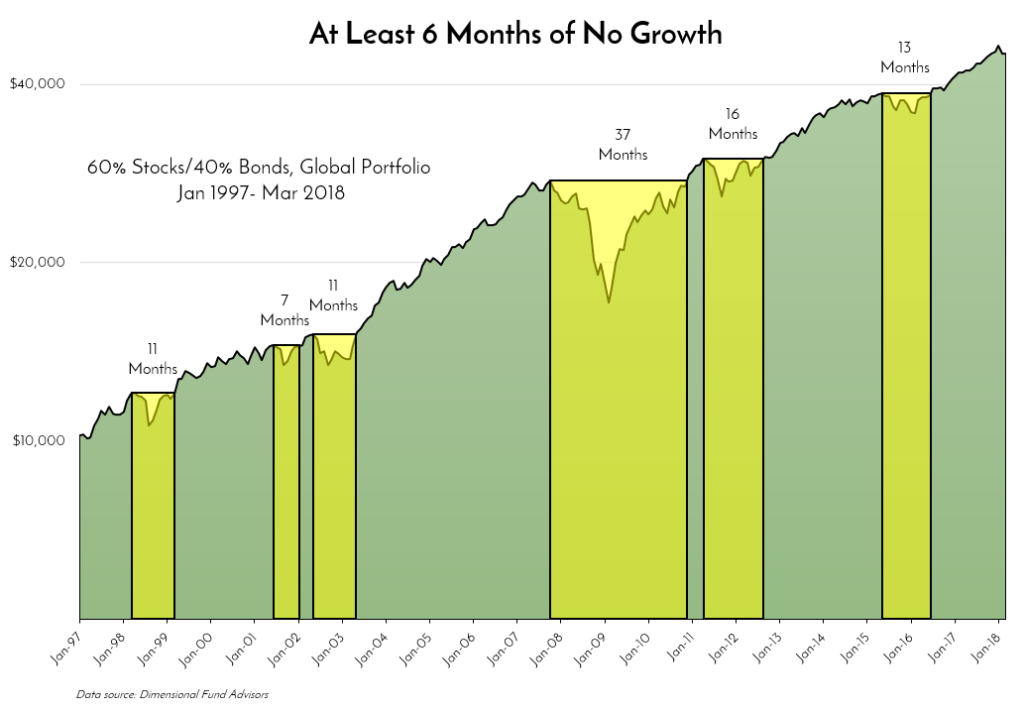

We had tremendous positive feedback last year when we sent our blog about the critical role of patience in investing. It’s a timeless lesson that we cannot afford to forget. So, we’ve decided that each year around this time, we will update the chart for your viewing pleasure. In some years, like this one, we will be in the middle of an overall upswing from the year prior (Hooray!). In others, we’ll be smack dab in the middle of one of those yellow areas (Booo!). Either way, the lesson will be the same: Risk equals reward…you just have to wait for it.

Two things are clear. First, long periods of no growth are common, and varied in length. Shorten the qualification to four months of no growth, and we see fourteen periods of no growth, covering 130 of the 255 total months. That means that for the last twenty one plus years, one’s investment experience was significantly flat 51% of the time. Second, and more importantly, since we know through academic evidence that no one can predict when these flat periods will begin or end, the key to realizing the reward is patience and discipline.

It’s certainly not easy to wait, to be patient. When we discuss investing, we talk in terms of five years, ten years, twenty years – never five days, or ten weeks, or even twenty months. But months of no growth can seem like an eternity. We tend to live our lives day to day. Many of us look at our investments the same way. But investment goals should be formulated and measured in years, if not decades. Dealing in days, weeks, months, or even a few years is not investing – it’s gambling. And as this chart clearly shows, being patient throughout those years is absolutely necessary for investing success.

Cheers,

John and Bill