The market is strange, isn’t it?

Covid hits. The human toll is heart-breaking. The economic toll is gut-wrenching. And then there’s the market. A dramatic fall beginning on February 20th of last year in response to the pandemic screeched to a halt just a month later, bottoming out on March 23rd. We haven’t looked back since, rocketing past pre-Covid levels to all new highs. At the bottom, nothing was yet better in the world, and it seemed like it never would be. Nonetheless, up went the market. Did you stay put?

This is the 5th edition of this chart, and we’ve always focused on the main lesson: patience wins. Let’s switch gears and talk about what culminated on last March 23rd: panic.

The general idea of investing is to buy low and sell high. Panic induces the opposite. It’s a terrible strategy! And once you’ve sold, when do you get back in? Odds are strong that you’ll end up buying higher. No one panics at the top. We panic at the bottom.

So…just don’t panic, right? It’s not that easy of course. Especially when the world was crumbling a year ago. But you have some weapons. First, educate yourself. Learn how the market works, what history tells us, and why it’s never “different this time”. Start with the chart below. Second, have a plan. It doesn’t have to be complicated. Just know when you’ll need to draw from your investments so that you only have money in the market that you’re not spending any time soon, which will allow you to weather the storm. And of course, we’re here to help you do both.

Be patient. Don’t panic. Be rewarded.

Cheers,

John, Bill, Mark and Melanie

About this chart:

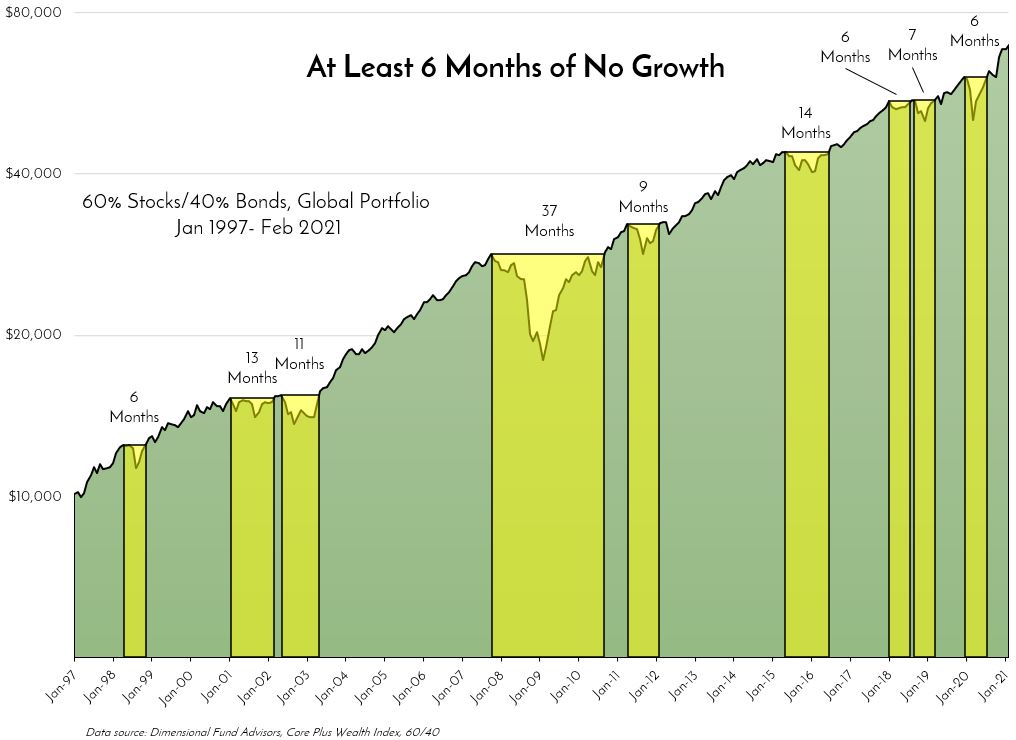

Two things are clear. First, long periods of no growth are common, and varied in length. Shorten the qualification to four months of no growth, and we see fourteen periods of no growth, covering 129 of the 290 total months. That means that for the last twenty-four years, one’s investment experience was significantly flat or down 44% of the time. Second, and more importantly, since we know through academic evidence that no one can predict when these flat or down periods will begin or end, the key to realizing the reward is patience and discipline.

It’s certainly not easy to wait, to be patient. When we discuss investing, we talk in terms of five years, ten years, twenty years – never five days, or ten weeks, or even twenty months. But months of no growth can seem like an eternity. We tend to live our lives day to day. Many of us look at our investments the same way. But investment goals should be formulated and measured in years, if not decades. Dealing in days, weeks, months, or even a few years is not investing – it’s gambling. And as this chart clearly shows, being patient throughout those years is absolutely necessary for investing success.