It’s OK. We’ve been here before. In fact, it’s a good thing. How can a down market be good? Well, without down markets, we would not have much of an up market. That is, risk equals reward. Stocks have averaged about 10% forever. And that’s more than cash, bonds, commodities, CDs, gold and other metals, annuities, currencies, collectibles, and just about anything else. But for that long-term reward, we must absolutely experience some short-term suffering – the manifestation of risk. They are inextricably related. Anything said to the contrary is either a sales pitch or a lie. And all the evidence tells us that attempting to maneuver around times like this will likely result in even lower returns.

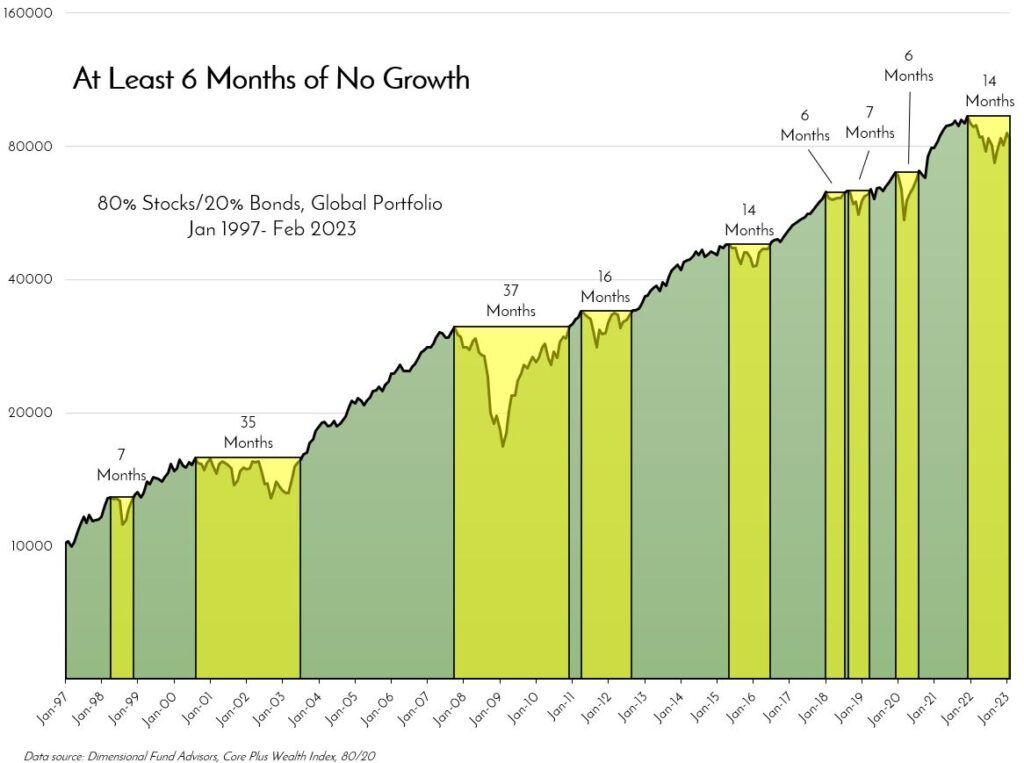

It’s been a rough fourteen months. The recent yellow block on the graph below shows us that. But take a look at the other yellow blocks. They all came, and it hurt…and they all went. But only those who persisted and stayed the course were rewarded. Never forget that.

While we hope you’d never revel in someone else’s failure, you should be proud that, unlike so many others, your patience will make you a winner. It’s no small feat.

About this chart:

Two things are clear. First, long periods of no growth are common, and varied in length. Shorten the qualification to four months of no growth, and we see fourteen periods of no growth, covering 163 of the 313 total months. That means that for the last twenty-six years, one’s investment experience was significantly flat or down 52% of the time. Second, and more importantly, since we know through academic evidence that no one can predict when these flat or down periods will begin or end, the key to realizing the reward is patience and discipline.

It’s certainly not easy to wait, to be patient. When we discuss investing, we talk in terms of five years, ten years, twenty years – never five days, or ten weeks, or even twenty months. But months of no growth can seem like an eternity. We tend to live our lives day to day. Many of us look at our investments the same way. But investment goals should be formulated and measured in years, if not decades. Dealing in days, weeks, months, or even a few years is not investing – it’s gambling. And as this chart clearly shows, being patient throughout those years is absolutely necessary for investing success.

Cheers,

John, Bill, Mark and Melanie