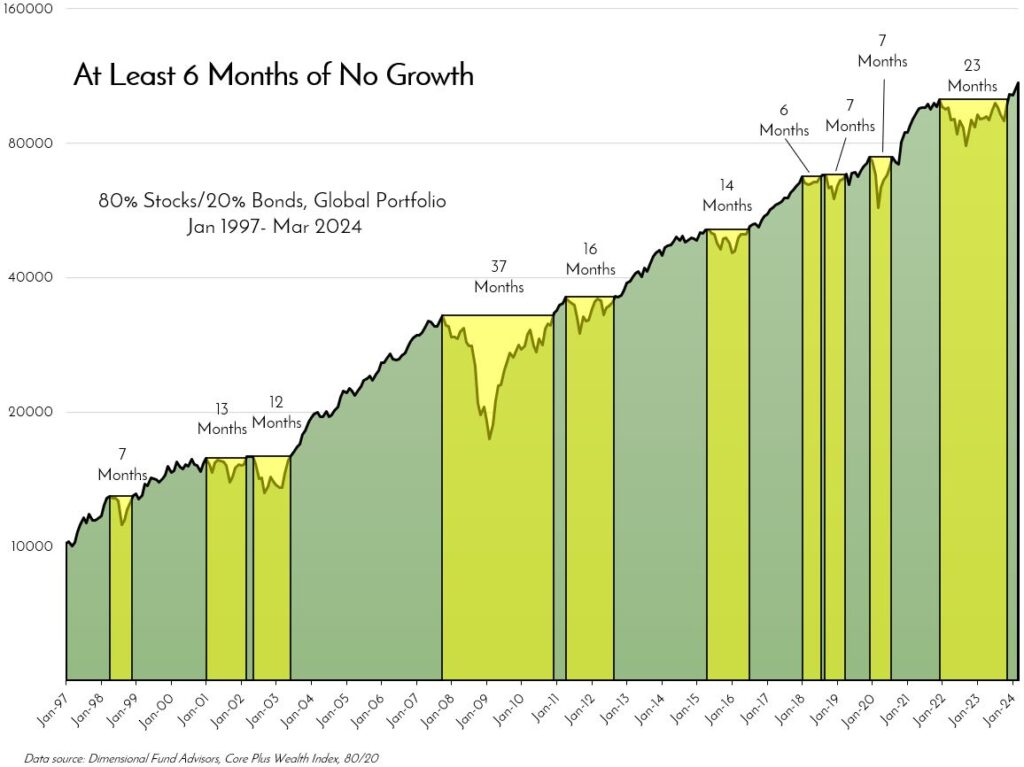

Well, that was no fun. But you made it! You are now on the other side of 23 months of no new highs, the second longest streak since ‘97. It started at the high on 1/4/22, bottomed out on 9/30/22, and now here we are after a furious 38% run up in global equities from there.

By the time we hit that bottom, how often did you hear “this time is different”? Ah, the most dangerous words in investing! Not because they were ever right, but because they have always been wrong. How many dollars were taken out of the market or never invested at all because “this time is different”? Sure, the reason the market was down at any point in our lives may have been different than other times. But the result has always been the same.

Look below. Does this last stretch of yellow look any different? Nope. The market goes up, meanders, goes up, meanders…wash, rinse, repeat. And it has done so amidst so many other “different” events: Brexit, Y2K, every single war, the Dot-Com Bubble, Black Monday, elections you liked, elections you didn’t like, a disappointing ending to Game of Thrones. Those were all supposed to be different. Yet, this last tough stretch ended in another all-time high, again – proof that it was never different, and the markets went higher.

Never confuse what you think of the world with what the market will do. They are unrelated.

So be patient. And be rewarded.

About this chart:

Two things are clear. First, long periods of no growth are common, and varied in length. Shorten the qualification to four months of no growth, and we see sixteen periods of no growth, covering 166 of the 327 total months. That means that for the last twenty-seven years, one’s investment experience was significantly flat or down 51% of the time. Second, and more importantly, since we know through academia and science that no one can predict when these flat or down periods will begin or end, the key to realizing the reward is patience and discipline.

It’s certainly not easy to wait, to be patient. When we discuss investing, we talk in terms of five years, ten years, twenty years – never five days, or ten weeks, or even twenty months. But months of no growth can seem like an eternity. We tend to live our lives day to day. Many of us look at our investments the same way. But investment goals should be formulated and measured in years, if not decades. Dealing in days, weeks, months, or even a few years is not investing – it’s gambling. And as this chart clearly shows, being patient throughout those years is absolutely necessary for investing success.

Cheers,

Your Great Oak Team