The “American Families Plan” will be debated and finalized in the weeks to come. Here are the key proposed changes:

- New income tax brackets:

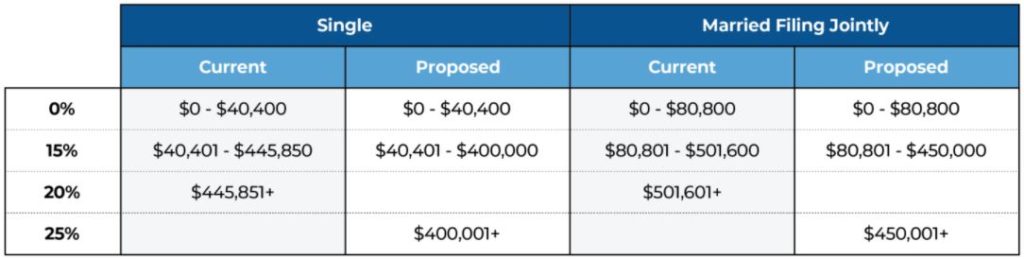

- New capital gains rates:

- 8% Net Investment Income Tax (NIIT): Certain high-income S-corporations will be subject to the NIIT, phased in, at thresholds of $400,000 for single filers and $500,000 for joint filers.

- New surtax: 3% will be added to the top income tax rate for those earning over $5 million, making the true new top rate 42.6%

- QBI: the maximum allowable Qualified Business Income deduction will be capped between $400,000 and $500,000.

- Back-door Roth Conversions: Will be eliminated beginning in 2022.

- Any Roth Conversion: Will be eliminated for high income earners beginning in 2032, with cliff thresholds at $400,000 for single filers and $450,000 for joint filers.

- Required Minimum Distributions (RMD) for Really Big Retirement Accounts: Beginning at the same income thresholds as above, the RMD would be 50% of retirement dollars over $10 million, and 100% over $20 million. This even includes Roth IRAs. At least they plan on waiving the 10% early withdrawal penalty on those amounts!

- Intentionally Defective Grantor Trusts: Will be effectively eliminated in the future, with existing such trusts grandfathered in.

- Estate Taxes: The exemption will be cut from the almost $12 million in 2021 to about $6 million.

We’ll keep you updated on how this all shakes out. Stay tuned…

Cheers,

John, Bill, Mark & Melanie