The saying “Risk equals reward” is incomplete on its own. For example, were you to say, “Risk equals reward, but not all risks are rewarded”, you’d be correct (that’s a topic for another time). Similarly, as the title of this post suggests, there’s a time factor involved in the reward side of this simple equation. We’d say, “Risk equals reward. You just have to wait for it.”

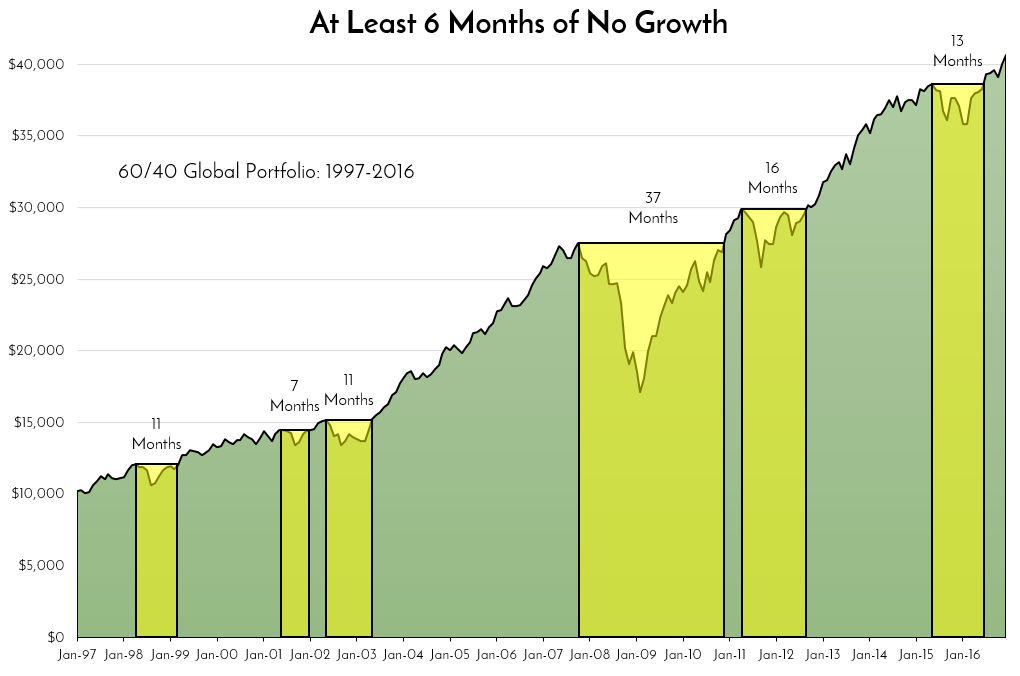

How long? You never know. And therein lies the risk. While we’ve recently hit new highs, the road to these levels has been peppered with stretches of no growth, or no reward for the risk – stretches that can make one second guess their approach. We’ve highlighted these stretches that have occurred over the last twenty years, using a typical client portfolio: globally diversified, with 60% in stocks and 40% in bonds.

Two things are clear. First, long periods of no growth are common, and varied in length. Shorten the qualification to four months of no growth, and we see fourteen periods of no growth, covering 130 of the 240 total months. That means that for the last twenty years, one’s investment experience was significantly flat 54% of the time. Second, and more importantly, since we know through academic evidence that no one can predict when these flat periods will begin or end, the key to realizing the reward is patience and discipline.

It’s certainly not easy to wait, to be patient. When we discuss investing, we talk in terms of five years, ten years, twenty years – never five days, or ten weeks, or even twenty months. But months of no growth can seem like an eternity. We tend to live our lives day to day. Many of us look at our investments the same way. But investment goals should be formulated and measured in years, if not decades. Dealing in days, weeks, months, or even a few years is not investing – it’s gambling. And as this chart clearly shows, being patient throughout those years is absolutely necessary for investing success.

Cheers,

John and Bill