A Cautionary Tale of “Chasing Returns”

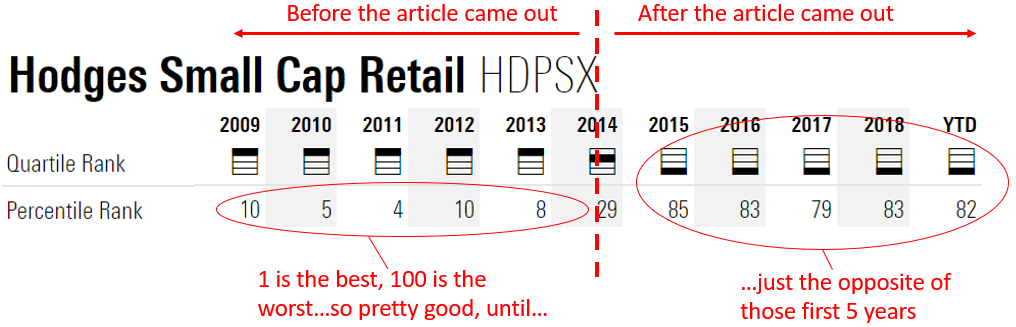

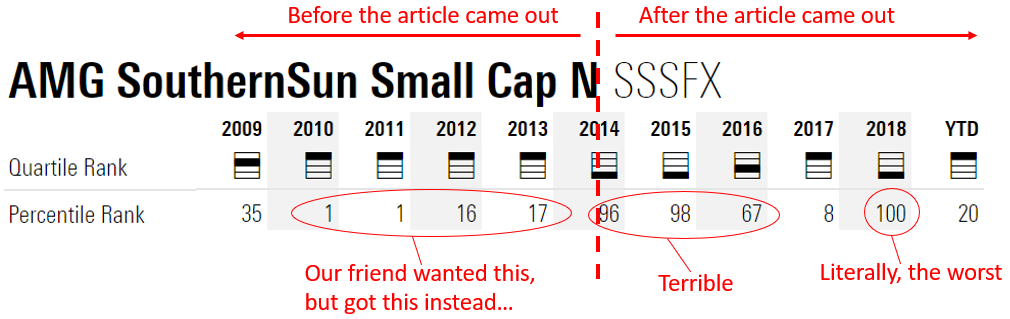

Just over five years ago, the New York Times published an article in which the author made the argument – successfully – that professional mutual fund managers cannot beat the market with any consistency or predictability. Old news, right? Yes, if you’ve been reading these blogs. But the article, which took into account the previous five years (March 2009-March 2014), pointed out that two funds had produced consistent, high-level returns during that timeframe, with both funds placing in the top quartile of returns each year. Of 2862 funds, no other funds accomplished that.

A friend of John picked up on this (which is how we found the article) and asked if he should put money into these funds. We said no. He did it anyways. Ugh…

He was convinced that these two funds must have a secret sauce, that the returns would at least be better than average. Well, here’s what’s happened since…

He didn’t waste too much money, but enough to learn an important lesson: Never chase returns. The evidence is strong, clear, and abundant. “Riding the hot fund” does not work.

John’s friend was hampered by “recency bias” – the idea that we put too much stock into recent events, despite what the long-term evidence warrants. We told him how, by pure odds, three funds (not just two) should have placed within the top 25% for 5 years in a row. In other words, the “success” of those two funds was just a coin flip.

Let’s leave the coin flipping to NFL referees.

Cheers,

John, Bill, Mark & Melanie

Here’s the original NYT article: