Patience Pays Off

If time doesn’t fly, it at least drives a Bugatti Chiron. Just a year ago, the Market Grinch stole Christmas with an awful fourth quarter. Had you turned on CNBC, you’d think it was World War 3, cities were burning, babies were crying, and that the Game of Thrones finale had already aired. And the headlines. Oh, the headlines. Here’s our favorite, from Christmas Eve, the day the market hit the bottom:

‘Worst Is Yet to Come’: Global Bear Market Just Getting Started (Mark Jolley on CNBC)

Oops.

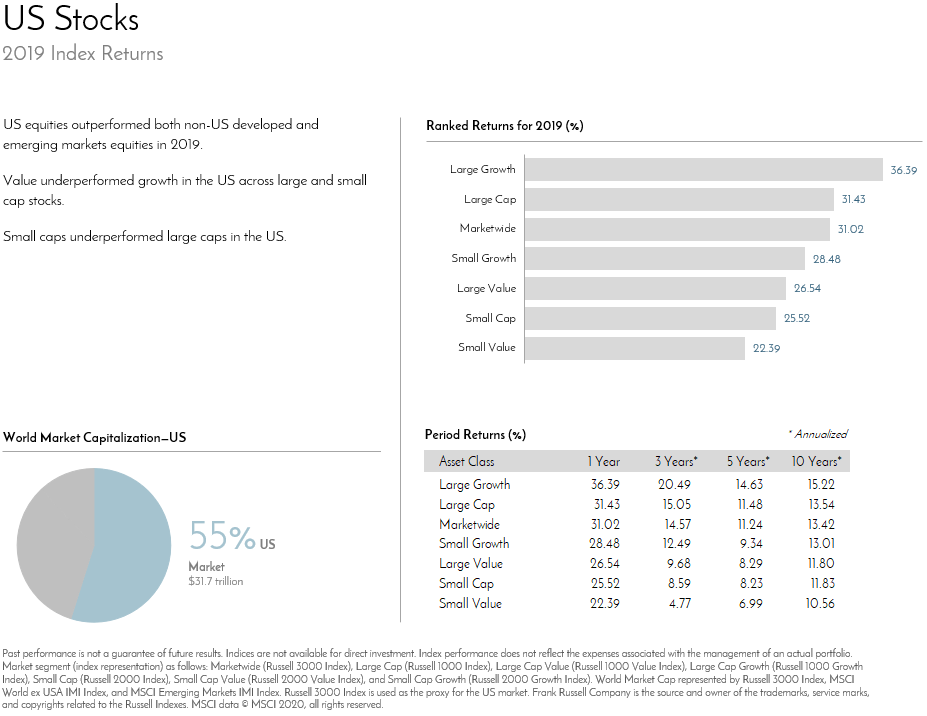

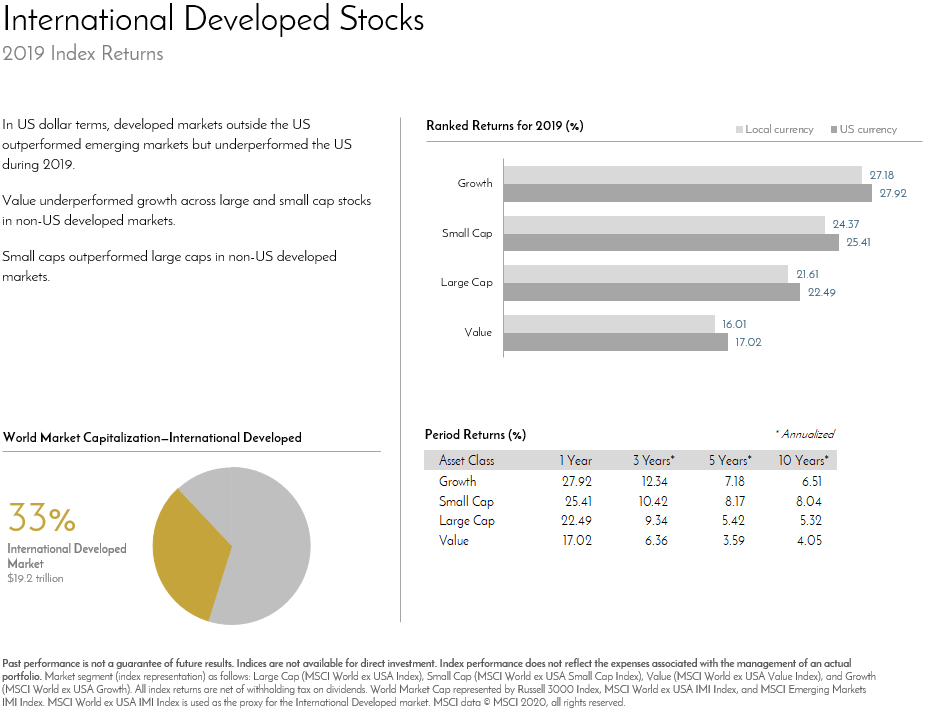

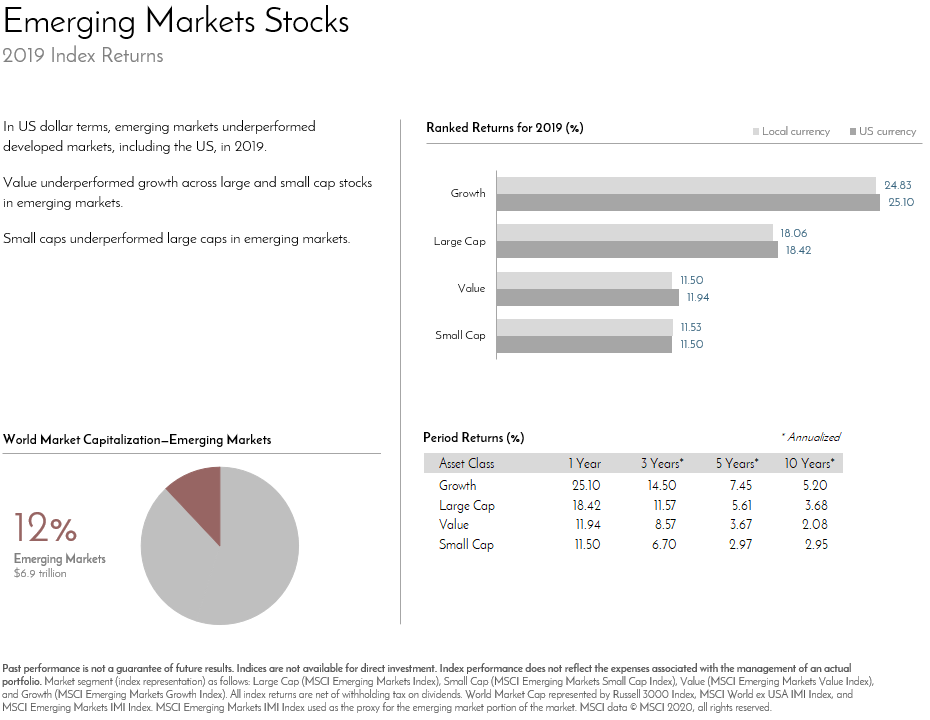

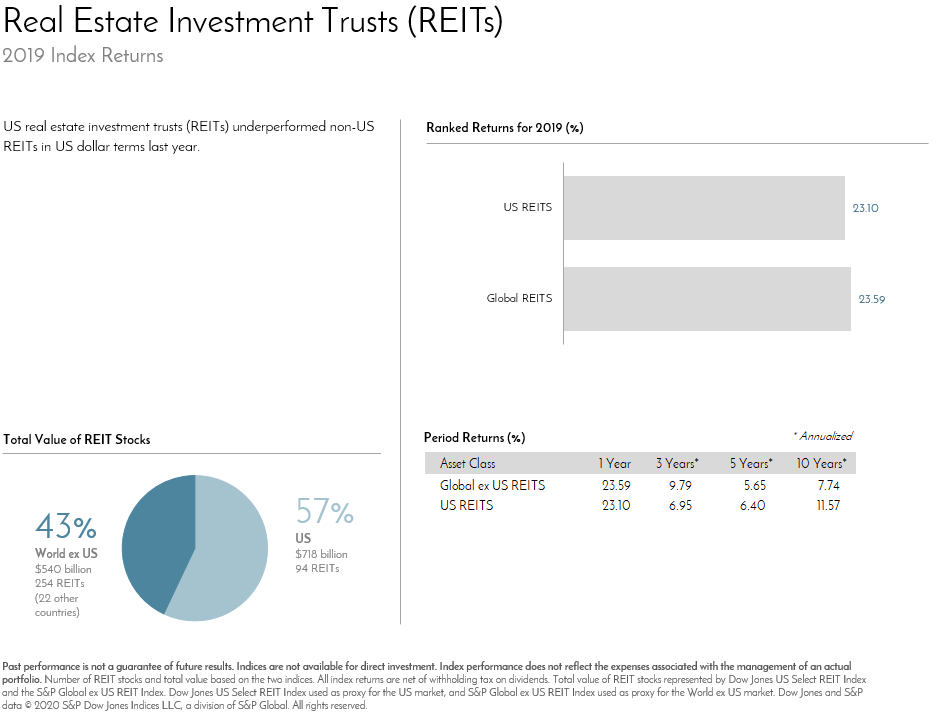

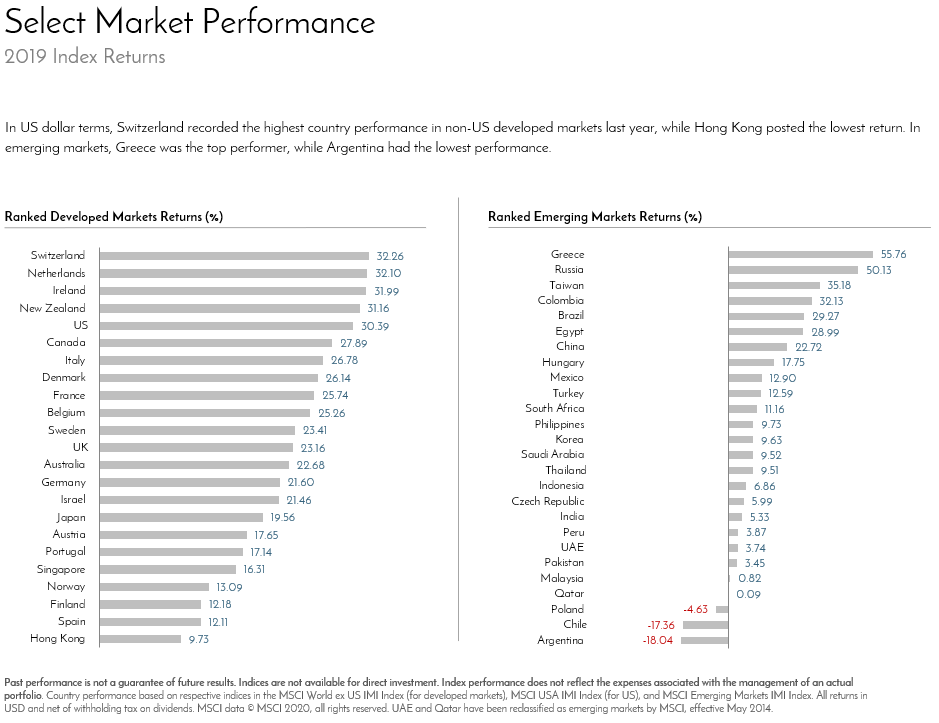

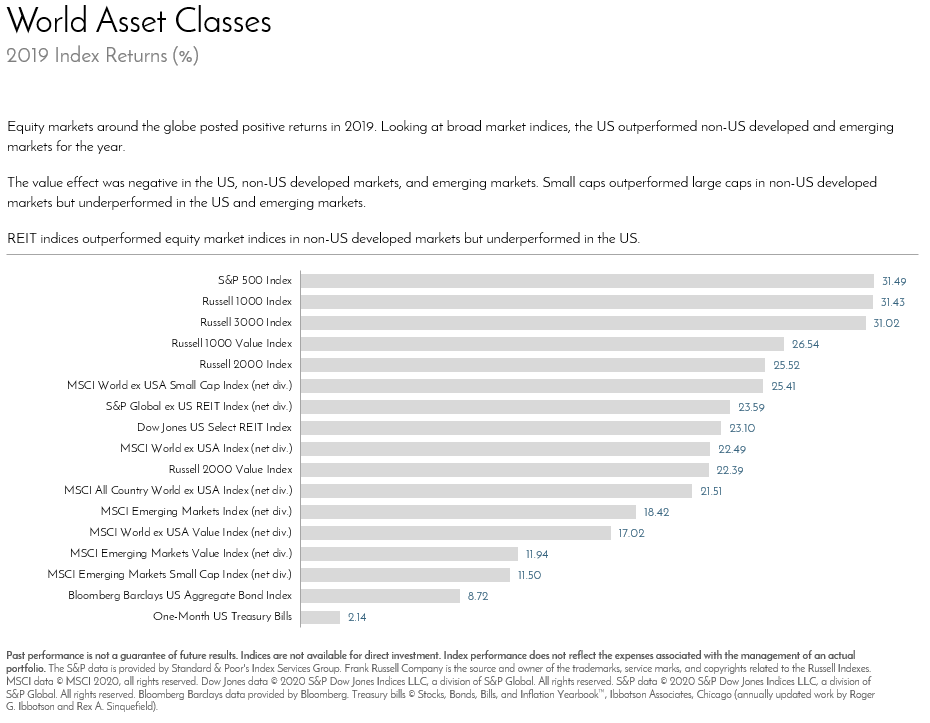

Fast forward to today, and the tone is far different. Investors are a fickle bunch, and a pretty good year tends to erase the memory of a terrible quarter. Globally, stocks were up about 23% in 2019. And 28% since that headline.

To be fair, the bear market could’ve kept going, and no one would really have been surprised. When you’re in the moment, especially on December 24th, 2018, thinking long-term is difficult. Our inherent recency bias kicks in and we never think markets will recover. But the bear market didn’t continue, and that’s why predictions like Mr. Jolley’s are so useless, and recency bias is so dangerous.

What is useful, without question, is patience. If you were rewarded for bearing the pain of last year, thank your patience. It’s the one thing above all else to which we can credit the success of any investment approach. Markets go up, markets down, and in the end, the patient win.

What does such a good year mean for the future? Everyone wants to know if, or wants to believe that, last year will have some kind of actionable impact on the next year: maybe buy more, or sell some, or establish a reverse iron albatross option spread – ya’ know, the normal stuff. In true “FOQ” spirit, the short answer is no, last year has no impact on this year. But historical perspective is admittedly fun, so we’ll continue down that road.

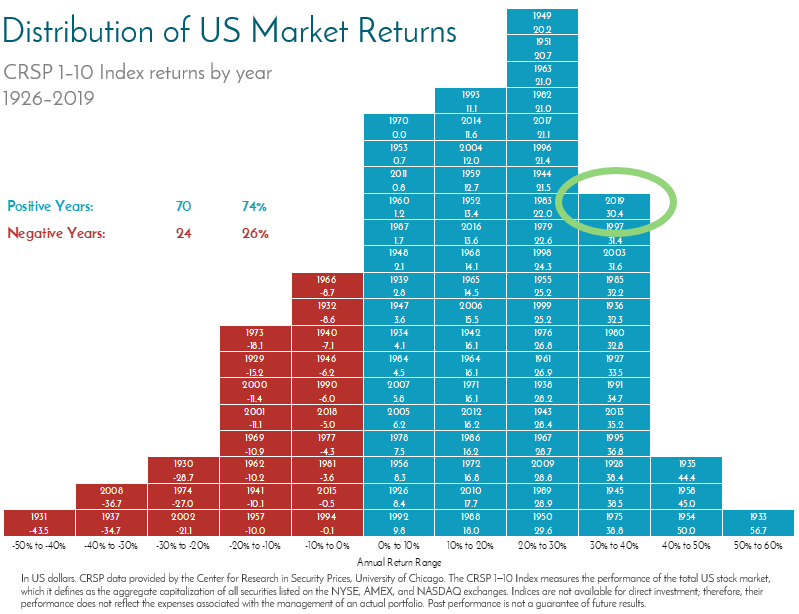

Sure, it was a good year, but one that fell within the normal range of returns. US stocks did particularly well, and here’s how 2019 fits historically:

Would you have guessed that there have been more years of 20-30% gains than any other decile? We were just 0.4% heavy from adding to that category. Of course, being in the 30%+ category is better! Gains of this size, 30%+, are not uncommon. They happen one out of every five and a half years.

So why does this matter? After big gains, everyone starts to wonder if we’re in for a big drop. Another short “FOQ” answer: unlikely. We wrote about this almost three years ago. In terms of the S&P 500, 80% of the time, stocks are higher over the next 12 months after we hit a new high, as we just did. And that’s a bit more often than when we’re not at a new high.

Historical perspective aside, no one knows what the future brings. The best we can all do is plan wisely, build a portfolio reflective of the best market knowledge we have, and then – you guessed it – have patience. If you work with us, we’ve done the first two for you already. The patience part – that will always be a work in progress. So here’s to growing, learning, and becoming better, more patient investors every day!

Wishing everyone a prosperous year,

John, Bill, Mark & Melanie