Add It to The List…Another Reason To Sell

Let’s play a game. We’ll rattle off some “market-shaking” events from the last 50 years, and you tell us if the market did NOT recover and make new highs soon after. Here we go…

The Kent State shootings (1970); US trade embargo against China (1971); Watergate (1972); Oil crisis (1973); Nixon resigns (1974); President Ford assassination attempts (1975); Lebanese civil war (1976); Yield curve inversion (1978); Three Mile Island (1979); 13%+ inflation (1980); President Reagan assassination attempt (1981); US unemployment over 10% (1982); Terrorists kill 237 Marines in Beirut (1983); Multiple terrorist hijackings (1985); Chernobyl meltdown (1986); Black Monday (1987); Savings & Loan crisis peaks (1988); Black Friday Mini-crash (1989); Gulf War begins (1990); US Recession (1991); L.A. riots (1992); World Trade Center bombing (1993); Bond market sell-off (1994); Oklahoma City bombing (1995); US budget crisis & government shutdown (1996); Largest Dow Jones point drop to date (1997); White House sex scandal (1998); Y2K fears erupt (1999); Tech Bubble bursts (2000); 9/11 attacks (2001); SARS outbreak (2002); Iraq war (2003); Asian tsunami kills 200,000 (2004); Hurricane Katrina (2005); Iran enriches Uranium (2006); Iraq war escalates (2007); The Great Recession (2008); H1N1 flu pandemic (2009); Flash Crash (2010); Euro debt crisis (2011); “Fiscal Cliff” (2012); “Taper Tantrum” (2013); Ebola outbreak (2014); First Dow Jones 1,000 point drop (2015); Brexit (2016); VIX “Fear” gauge hits all-time low (2017); Bear market (2018); Yield curve inverts (2019).

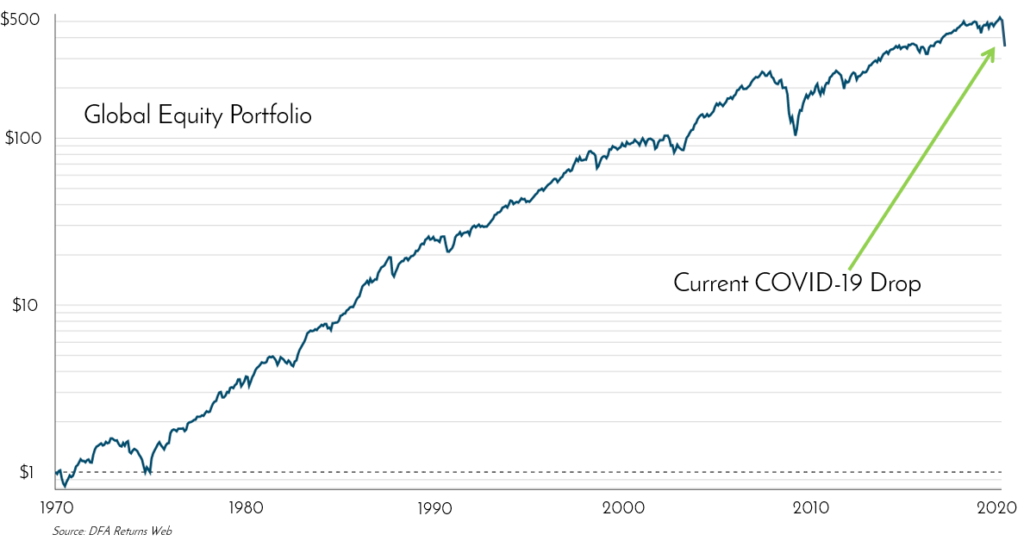

Bring back memories? They’d be vague, for most people. But at the time, each of these events carried far more weight than they do now as memories. Had you known in advance about all these events, would you have guessed a chart of the market would have looked like this?

All of this certainly puts the current coronavirus mania into perspective. If we didn’t draw the arrow, would you have known that the graph is current through Friday’s close? While the virus seems like a big deal now (and many of these events are still a big deal from an emotional, personal and human standpoint), from a financial standpoint, we’d bet that the market will soon forget it, as it always has. We’ll add it to the list of reasons to sell today, and to the list of what the market will forget tomorrow.

They’re the same list.

Cheers,

John, Bill, Mark & Melanie