For the final season of Stranger Things, no! We want it now. How about for this gloomy market to end? You absolutely can wait for that. There’s no need to worry.

To understand why, let’s look at who probably cannot wait. Those who: market time, have money in individual stocks, chase trends like bitcoin, sell and go to cash. None of those strategies can rely on time to produce a successful investing experience. They all are just as likely to lock in losses as they are to recover, no matter how long one waits. It’s gambling, but without the free drinks.

On the other hand, you as a client (or future client?) have two advantages which should inspire confidence in the eventual upward direction of your portfolio.

First, you own not just one stock but just about all of them, over 14,000 across the entire globe. A singular stock may never come back. The market as a whole has always come back. And as long as capitalism exists, you should be very confident that the market will come back once again.

Second, your portfolio reflects the amount of time you have before you need to spend the money. Some of you have accounts with all bonds and cash – no stocks. That’s money you plan on spending soon. Those accounts haven’t been hurt by the drop in stocks, by design. Some of you have all your money in stocks, also by design. Those accounts are down. But that’s OK – it’s money you don’t need to spend until much later.

For those two reasons, time is your best friend in investing. Your globally diversified portfolio is positioned to wait out this downturn, as the money you’re spending now, be it savings or income, is not exposed to the risk of the market.

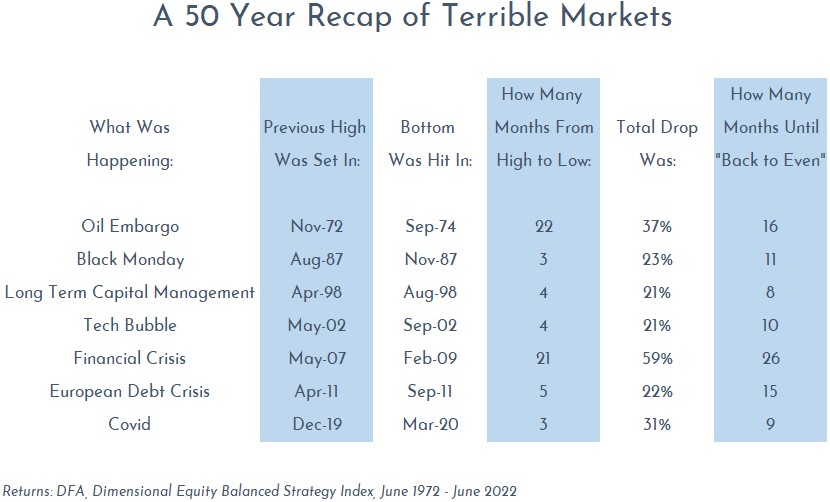

You may be thinking “Well, how much time?”. In the six-plus months from January 4th to July 14th, your stocks dropped as low as 19% from their high (Though the 8% rebound since then has been quite welcomed!). Let’s round up and call it a 20% drop – what commonly defines a “bear market”- and look back at the bear markets of the last fifty years.

The middle blue column is most important to this discussion. It tells us how long the market dropped before it started to come back. While they all hurt at the time, five of the seven were just blips. The Oil Embargo and the Financial Crisis lasted much longer. Regardless of how long it took to come back, any money that got hit that bad had plenty of time to recover. And it always did. Every time.

So remember: It’s time in the market, not timing the market, that leads to success.

Cheers,

John, Bill, Mark & Melanie