It’s getting closer. And the closer it gets, the more people wonder and/or worry about what effect the election may have on their portfolio.

For those of you who have been with us a while, I think you know what’s coming. But a little reminder never hurts. And for the newbies, behold the power of the markets!

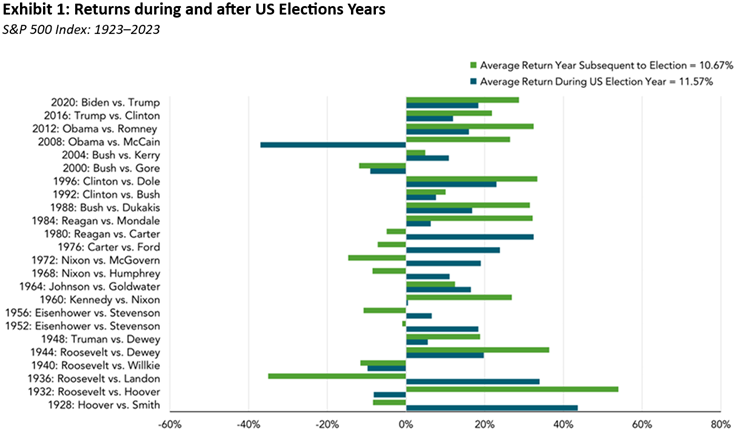

The S&P 500 has averaged about 10.4% annualized since 1926. Now look at the averages at the top right. Nothing out of the ordinary, right? Even a bit better, particularly during the election years (coincidently, this year too). Whether it’s the year of the election or the year after, all is well in Stocksville USA.

Furthermore, only three presidents on this list saw a negative return during their tenure. Guess which ones. One is easy, the other two may not jump out at you.

Of course, averages are averages. Anything can happen in a given year, and this graph proves it. Dig deeper and you’ll find that for any bar on the graph that shoots to the left, there’s one thing in common: nothing! No one party nor policy nor pick of presidential pooch can be blamed for any of it. The D’s and the R’s and all their differences haven’t gotten in the way of investors. Their records are pretty much even, and all positive. Here’s more to that point: https://greatoakcp.com/the-election-how-to-position-your-portfolio-2/ .

One last tip: if you hate all the political ads, just watch Netflix.

Cheers,

Your Team at Great Oak