Depending on the winner of the presidential election, there’s something you’ll absolutely want to do with your portfolio. If Biden wins, you should…

…do nothing.

But on the other hand, if Trump wins, you should…

…also, do nothing.

Were you expecting a big secret? An actionable insight?

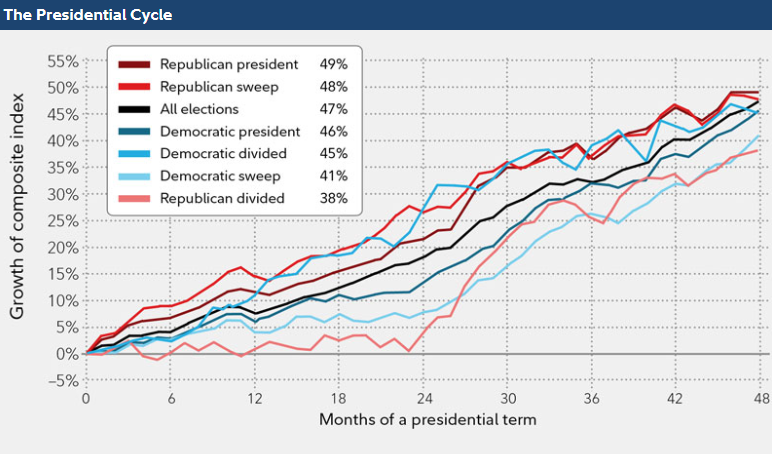

Your portfolio doesn’t care who wins, because there hasn’t been much of a difference throughout history. This graph illustrates the point. It details how the US markets have done under each scenario back to the very first election (For this discussion, we’re omitting any other once-prominent parties. Apologies to any Whig party sympathizers!):

Source: S&P 500, DJIA, Cowles Commission

That’s a tight range of outcomes. No real winner or loser. Most importantly, notice that every outcome has been positive. No one lost any money because the “other side” won. Markets certainly fall for many reasons, but the party of the White House occupant is not one of them.

We’ll bet you every dollar we have that over the next few months the media, whether traditional or social, will do its best to make you believe otherwise, despite the overwhelming evidence supporting the accuracy of our contention. And that’s OK. It’s their job – not to give you sound advice based on your personal situation, but to simply get you to tune in, regardless of the ridiculousness or the consequences. So please, tune it out, if for nothing else, for the sake of your portfolio.

Regardless of how this all shakes out, you should do with your portfolio what all the evidence says works best: keep costs low, diversify, don’t time the market, and stay disciplined. It’s a simple formula, and it works. Of course, simple doesn’t mean easy. But that’s why we’re here for you.

Cheers,

John, Bill, Mark & Melanie