The Dangers of Following the Herd

We’ve heard it a thousand times before: “Well, I just picked that fund in my 401(k) because my co-workers did too”, or, “Everyone is buying weed stocks. I’m thinking of buying some too”. And the worst of them all: “The market is tanking. I want to sell”.

It’s called “herding”. Like most of our innate behaviors, it has helped our species, and others, survive throughout the generations. When faced with a lack of information, we turn to the crowd to see what they’re doing, hoping to find some direction. It’s why penguins line up to jump into the water – must be time to eat!

But it’s also why we buy into market bubbles, like the Dot-Com era in 2001. It all made sense because, you know, everyone else was doing it – not because of any data, evidence or scientific research. And we all know how that ended. The same goes for 401(k) choices, the stock du jour, and selling when the market is down. No evidence – just getting in line and diving.

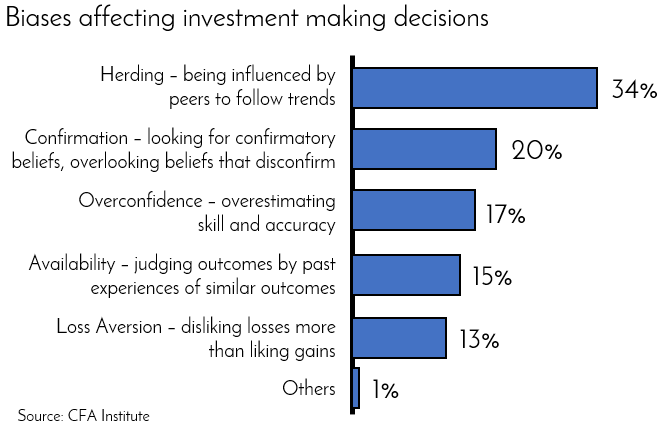

It’s not surprising. A study by the CFA Institute (below) discovered that herding is the topmost bias affecting investment decision making.

All these biases make the Evidence-based Investment Approach that much more appealing. Trade in your biases for logic, discipline and objectivity, and investment success becomes much more likely.

Cheers,

John, Bill, Mark & Melanie