You Asked, So We’ll Answer

FOQ: The last market high was 17 months ago. Will it ever go up again?

Short: Of course.

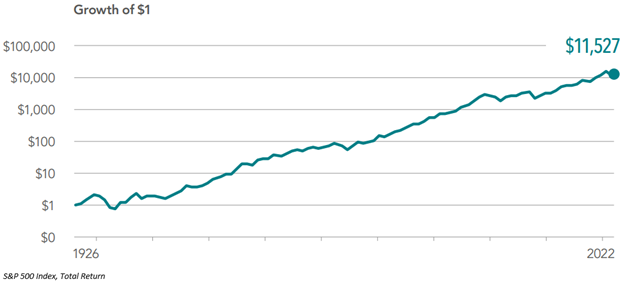

Long: Sideways, down, bumpy, jumpy – whatever the market has thrown at us, since its very beginning many generations ago, it has always recovered and pushed onward to new highs. The current rut is of the sideways variety (at this point). Let’s put it into context:

It’s certainly not a straight line…but it’s not as crooked as you might’ve thought, we bet. Nevertheless, every one of those bumps on the way up hurt, just like the one at the end that’s happening now. And they all happened for reasons that, at the time, many people would’ve said “It’s different this time”.

Yet the chart spins a different narrative. We hit a high, we hit a rough patch, we hit another high. Wash, rinse, repeat. It’s never different.

FOQ: So what should we do?

Short: Nothing.

Long: Well, sort of. This assumes you have your portfolio properly constructed in the first place. If you can say you keep your costs low, are diversified, occasionally rebalance, never time the market, and integrate “factors” into your portfolio, then you’re good! That is, clients = good. Not a client = ???.

But if any of those five principles are absent from your portfolio, you should do something (like maybe…call us!). Because when the market finally breaks out of its rut, you want to be there to capture all the upside you deserve for having taken that risk for so long. It’s your right.

FOQ: Can artificial intelligence help? It’s all over the news these days.

Short: Not yet.

Long: Remember IBM’s Watson? It’s the A.I. computer that beat Ken Jennings at Jeopardy. Ken is the greatest Jeopardy player of all time. A fund was launched in 2017 using Watson to attempt to pick stocks that would outperform the US market. It seems that the world’s smartest computer is no match for the collective wisdom of the market, as the fund’s return since inception is less than half that of the market. Oh well – it was worth a try!

Cheers,

Your Team at Great Oak