You Asked, So We’ll Answer

FOQ: They say the “yield curve inverted”? What does that mean?

Short: Short-term bonds had higher interest rates than long-term bonds.

Long: In particular, last Wednesday morning, the interest rate of the 2-year Treasury note very briefly exceeded the rate of the 10-year note. Think of these notes as CDs at the bank. You’d surely expect to get a higher interest rate from a 10-year CD than a 2-year CD, since you’re locking the money up for so much longer. But for a hot minute, that was not the case.

FOQ: Does it matter to the stock market?

Short: Barely

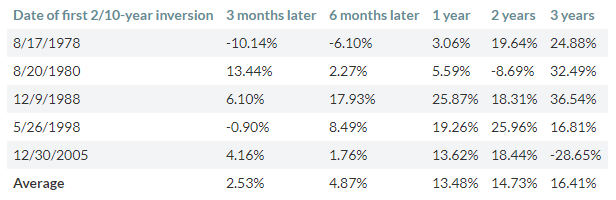

Long: Here’s what happened to the S&P 500 after a yield inversion, over the last 40 years:

Source: Dow Jones Market Data

So much for all the hubbub. These are quite normal returns. In general, the market tends to rise, and it’s been no different after a yield inversion.

FOQ: And what about a recession? And my investments?

Short: Maybe. Maybe not.

Long: There is great debate about the ability of a yield inversion to predict a recession these days. But let’s say we get one anyways. It’s not the recession that matters. Since WWII, the market has increased by an average of 5.6% during a recession. It’s before a recession that the market, on average, has fallen, about 8%.

But here’s the rub. The yield inversion, in the past, has helped to predict recessions, but it has not predicted when they started. And as you can tell by the chart above, the market does just fine after the yield inverts. So in a nutshell, here’s how it’s gone in the past: the yield inverts and the market goes up, until it doesn’t…then the recession hits and the market goes up again. Probably the opposite of what you were thinking! But either way, to profit from any of this movement, you’d have to be able to time when everything would happen. And we all know by now that timing the market is a fool’s errand. Stay the course.

Cheers,

John, Bill, Mark & Melanie