You Asked, So We’ll Answer

FOQ: What are these “fang” stocks?

Short: It’s “FAANGM” these days…Facebook, Apple, Amazon, Netflix, Google and Microsoft.

Long: The media loves a nickname, and so this group of the premier tech companies in the U.S. now has one. It was originally just “FANG” (coined by Jim “Mad Money” Cramer, with no Apple or Microsoft), but an extra “A” was an easy addition to honor the world’s largest company. Apologies to Microsoft, but an “M” just doesn’t quite fit anywhere. Yet, it’s size and influence demanded inclusion too. So you’ll see “FAANGM” all over CNBC and other peddlers of pecuniary porn. Not as smooth sounding as the original, but certainly fair.

FOQ: Why are they a big deal?

Short: Recently, big returns. And big valuations.

Long: If you rolled the dice and put an equal amount of money in each at the beginning of the year, you’d be up over 55% so far. In a Covid-19 world, or any world, that’ll make headlines for sure. Furthermore, these returns made these companies – minus Netflix – 5 of the largest 6 in the world (Netflix ranks 21st). When they move, up or down, the market moves with them. The attention is deserved. Sure, DraftKings, a sports betting website, is up almost 400% for the year, but it’s still less than 1/100th the value of Apple. Few people have noticed.

FOQ: If they’ve done so well, why don’t we put all our money in them?

Short: Bad idea.

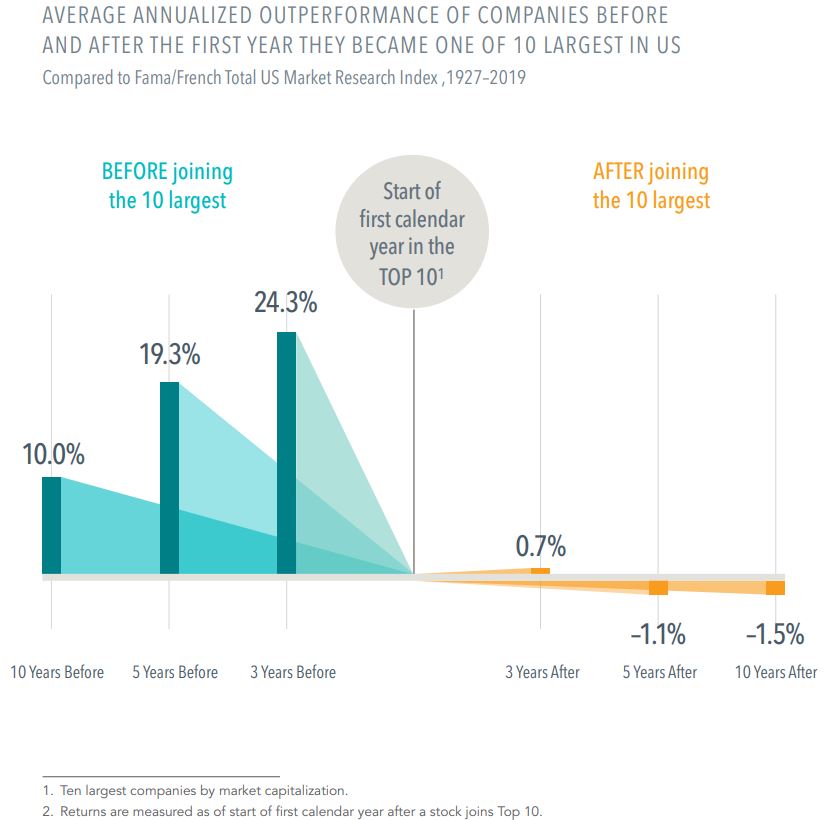

Long: That’s called “chasing returns”. If it were as simple as buying the recent winners, we’d all be rich. But the market is cruel. Any seemingly easy strategy like that is very likely to fail, and typically right after you buy into it! Here’s some interesting data on what happened to stocks that become the largest:

The blue is what we wanted, but then the orange is what we got. Is this the fate of the FAANGMs? No one knows. But if you were around for the tech bubble of the late 90’s, it sure feels awfully familiar. And we know what happened then. But what’s an 85% drop amongst friends, right?

Take solace in knowing that if you have a diversified portfolio, you own lots of these FAANGM stocks, and have benefitted greatly from their inclusion in your portfolio. And when the exuberance fades, as it always has, you’ll be glad you’re diversified to pick up the slack.

As it always has.

Cheers,

John, Bill, Mark & Melanie