You Asked, So We’ll Answer

FOQ: Why do I keep hearing about “SPACs”?

Short: When celebrities like Shaquille O’Neill and Serena Williams get involved in an investment, it makes headlines.

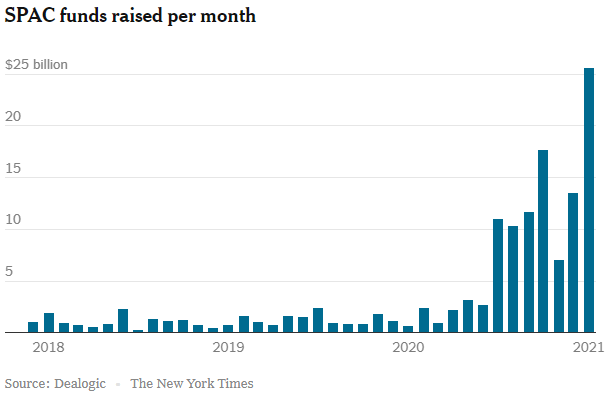

Long: It’s a new craze that’s getting a lot of attention. They were invented in the ‘90s, but recently, this happened:

FOQ: So what is a SPAC?

Short: Special Purpose Acquisition Company

Long: They are “blank check” companies with no operating history, where the founders raise money from investors with the hope of one day finding another company to buy with that money. If a traditional IPO is a company looking for money, a SPAC is money looking for a company. There will likely be a target industry or business, but a SPAC can change course at any time, thus changing the risk profile too. For many SPACs, the founders receive 20% of the business, which is a huge conflict of interest. They must typically acquire or merge with another company within two years or return the investors’ money, which incentivizes the founders to get any deal done, even if it is not a good one for the investors.

FOQ: Should I buy into one?

Short: Probably not.

Long: If a SPAC does its job, then it will eventually become a normal stock like any other, no longer a “blank check”, ready to be integrated into a diversified portfolio. But until then, imagine this conversation…

Advisor: Hey, you should buy this stock. It’s a SPAC!

You: Sure. But what business does the company do?

Advisor: Well, none, actually. It doesn’t even make any money or have any revenue.

You: Huh?

Advisor: Well maybe someday it will, but not yet! Or maybe it won’t. Who knows?! Why not take a shot?!

You: I can see you’ve taken a shot or two already today.

Cheers,

John, Bill, Mark & Melanie