The short answer: yes.

But let’s add some perspective.

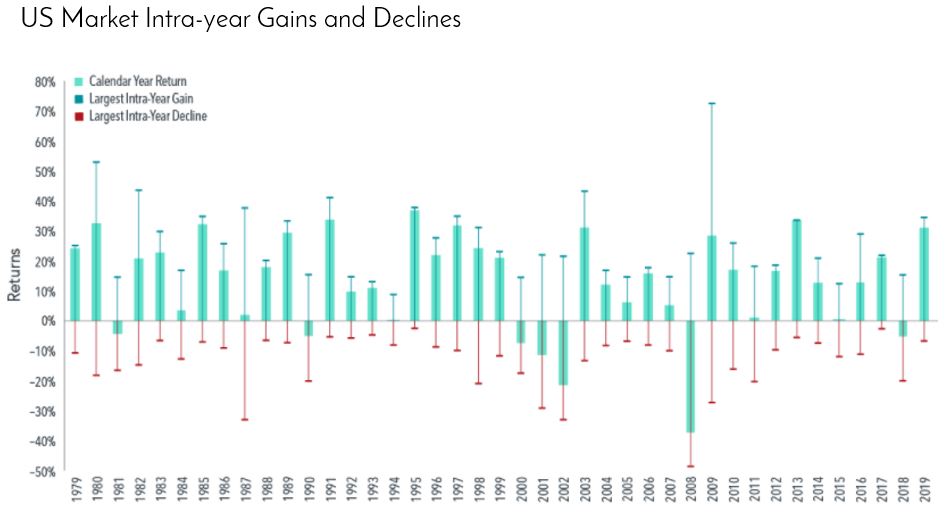

You may read a lot about volatility – or how much the market goes up and down – being the “new normal”. Covid surely isn’t helping any. But this “new normal” is simply normal. Volatility has been an integral part of the investing experience since the very beginning. As a perceived risk, it’s one of the reasons stocks have produced, and are expected to produce, higher returns than less volatile assets like bonds and cash. Risk equals reward, as they say.

Over the years, we’ve had it better, we’ve had it worse.

The magnitude of the ups and downs these days, in terms of points, might seem greater than days past. Indeed it is, simply due to math. Twenty years ago, the Dow traded at about 10,000. Today, it is north of 27,000. The average daily movement of the Dow since 1928 has been about 0.75%, in either direction. In 2000, that was 75 points. Today, that’s 200 points – seemingly more volatile, but no different mathematically. It’s still the same amount of money.

As a practical matter, you should ignore volatility in the short term. Any money you need to spend any time soon shouldn’t be exposed to much, if any, volatility. But for long term money, embrace it. It’s part of what makes your portfolio grow.

Cheers,

John, Bill. Mark & Melanie