Why This Happens

Since March 23rd, as you read this, unemployment has jumped off the charts (even after Friday’s report). More businesses have shuttered permanently. GDP forecasts have soured. The decline in industrial production was worse than any time during the Great Depression. Confirmed world corona cases have soared from 335,000 to 6,931,000. Deaths, from 14,700 to 401,000.

All after March 23rd.

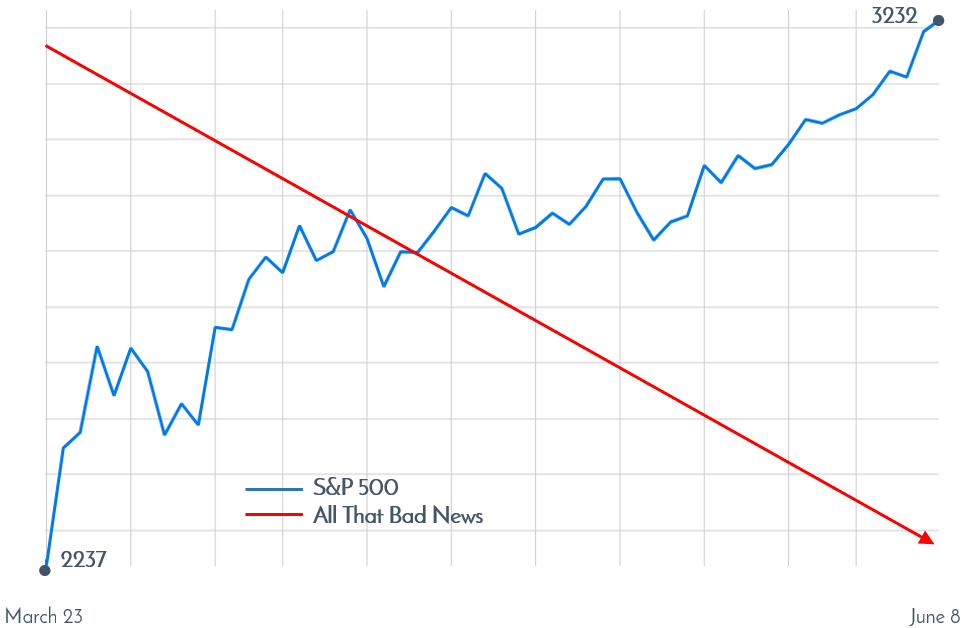

Here’s an extremely, if not ridiculously, crude chart of all that bad news, alongside the return of the S&P 500 during that time:

That’s a 44% gain for the S&P. To quote John’s mom, “It just doesn’t make any sense!”

You see, the market is a forward-looking mechanism. It doesn’t care what happened last week, today, or even what’s going to happen next week. The market is making a guess about next year, or even the next few years. To the market, what’s done is done. It’s much like the last crash, the 2008-2009 financial crisis. Then, by the time the economy started to show life in the fall of 2009, the market had already rebounded by over 50%.

It makes sense. Speculators (gamblers) care about what happens tomorrow. Investors (you) have a longer outlook. Five years, ten years, twenty years from now. Even if you’re retired, some of your money is pegged for those longer time frames. Neither what happened in 2009 nor what is happening now will have much, if any, effect on where the market is five, ten or twenty years from now.

In short, the market does not equal the economy. Always remember that, and a better investor you will be.

Cheers,

John, Bill, Mark & Melanie