John’s little cousin would say that to him quite a bit. He’s still not sure what it means after all these years. Hopefully it’s good. He’s too old to know.

You know what else is old? The market. It’s been around longer than anyone reading this. Since its birth it’s been the definition of random – or in other words, patternless.

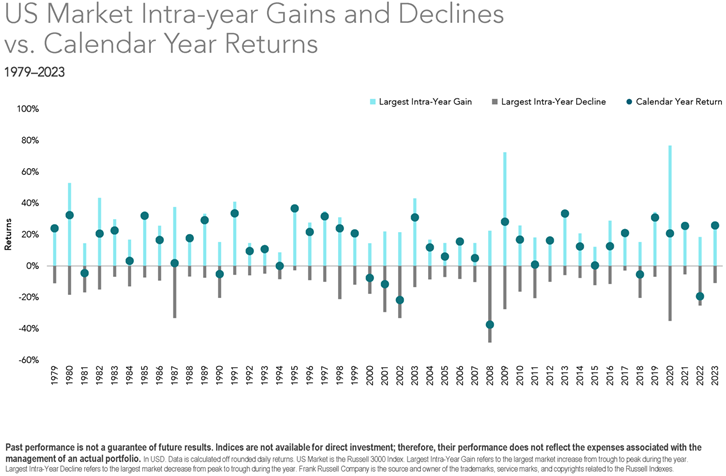

Look at the last forty-five years below. The dots are yearly returns of the market. The lines are the high and low points in that year.

Now try to find a pattern. (But don’t try for too long, because – spoiler alert! – there isn’t one.)

But that won’t stop us from trying to find one. It’s in our blood. Psychologists call it the “Gambler’s Fallacy”, the idea that we as humans seek patterns and causality in events to make sense of the randomness of things – in this case, the randomness of markets.

It’s a dangerous concept. Every ounce of data says there are no patterns to market returns. Yet most people are convinced that patterns exist. You might say we need them to exist. In turn, market timing runs rampant, which at its worst can completely ruin a retirement.

Please remember: it is not market timing that breeds success – it is time in the market.

Cheers,

Your Great Oak Team